Shutterfly 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

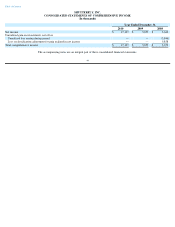

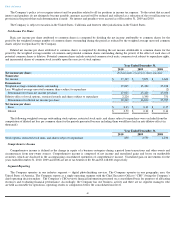

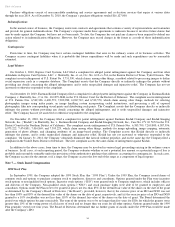

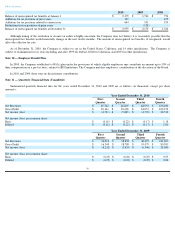

Goodwill

Changes in the carrying amount of goodwill are as follows (in thousands):

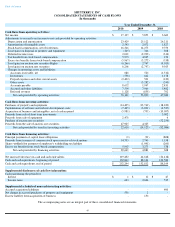

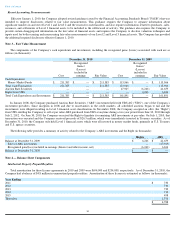

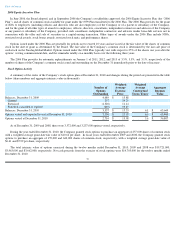

Accrued Liabilities

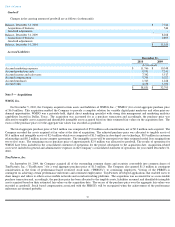

Note 5 — Acquisitions

WMSG, Inc.

On November 5, 2010, the Company acquired certain assets and liabilities of WMSG, Inc. (“WMSG”)

for a total aggregate purchase price

of $6.0 million. This acquisition enabled the Company to provide a complete solution for variable digital print marketers and other print-on-

demand opportunities. WMSG was a privately-

held, digital direct marketing specialist with strong data management and marketing analytics

capabilities located in Dallas, Texas. The acquisition was accounted for as a purchase transaction and accordingly, the purchase price was

allocated to tangible assets acquired and identifiable intangible assets acquired based on their estimated fair values on the acquisition date. The

excess of the purchase price over the aggregate fair values was recorded as goodwill.

The total aggregate purchase price of $6.0 million was comprised of $5.8 million cash consideration, net of $0.2 million cash acquired. The

Company recorded the assets acquired at fair value at the date of acquisition. The adjusted purchase price was allocated to tangible assets of

$0.6 million and intangible assets of $2.4 million which was comprised of $1.3 million in developed core technology, $0.9 million in customer

relationships and $0.2 million in non-

compete agreements. The intangible assets will be amortized over their estimated useful lives ranging from

two to five years. The remaining excess purchase price of approximately $2.9 million was allocated to goodwill. The results of operations for

WMSG have been included in the consolidated statement of operations for the period subsequent to the acquisition date. Acquisition-

related

costs were included in general and administrative expenses in the Company’

s consolidated statement of operations for year ended December 31,

2010.

TinyPictures, Inc.

On September 10, 2009, the Company acquired all of the outstanding common shares and securities convertible into common shares of

TinyPictures, Inc. (“TinyPictures”)

for a total aggregate purchase price of $1.3 million. The Company also granted $1.3 million in contingent

consideration in the form of performance-based restricted stock units (“PBRSUs”)

to continuing employees. Vesting of the PBRSUs is

contingent on achieving certain performance milestones and continued employment. TinyPictures developed applications that enabled users to

share images and videos to others across mobile networks and social networking platforms. The acquisition was accounted for as a non-

taxable

purchase transaction and, accordingly, the purchase price has been allocated to the tangible assets, liabilities assumed, and identifiable intangible

assets acquired based on their estimated fair values on the acquisition date. The excess of the purchase price over the aggregate fair values was

recorded as goodwill. Stock based compensation associated with the PBRSUs will be recognized when the achievement of the performance

milestones are deemed probable.

Table of Contents

Balance, December 31, 2008

$

7,724

Acquisition of business

544

Goodwill adjustments

-

Balance, December 31, 2009

8,268

Acquisition of business

2,895

Goodwill adjustments

-

Balance, December 31, 2010

$

11,163

December 31,

2010

2009

In thousands

Accrued marketing expenses

$

11,766

$

10,548

Accrued production costs

8,551

7,241

Accrued income and sales taxes

7,342

5,517

Accrued compensation

5,701

5,227

Accrued purchases

1,313

1,228

Accrued other

4,158

3,032

$

38,831

$

32,793

52