Shutterfly 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recent Accounting Pronouncements

Effective January 1, 2010, the Company adopted revised guidance issued by the Financial Accounting Standards Board ("FASB") that was

intended to improve disclosures related to fair value measurements. This guidance requires the Company to separate information about

significant transfers in and out of Level 1 and Level 2 and the reason for such transfers, and also requires information related to purchases, sales,

issuances, and settlements of Level 3 financial assets to be included in the rollforward of activity. The guidance also requires the Company to

provide certain disaggregated information on the fair value of financial assets and requires the Company to disclose valuation techniques and

inputs used for both recurring and nonrecurring fair value measurements of our Level 2 and Level 3 financial assets. The Company has provided

the additional required disclosures effective January 1, 2010.

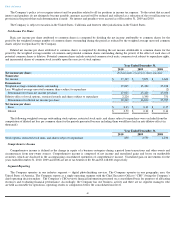

Note 3 – Fair Value Measurement

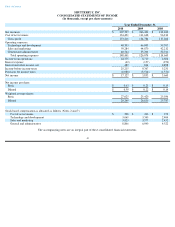

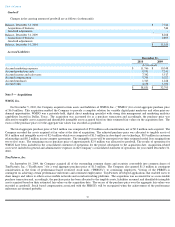

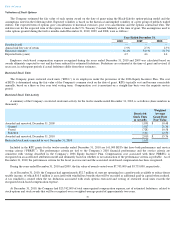

The components of the Company’

s cash equivalents and investments, including the recognized gains (losses) associated with each are as

follows (in thousands):

In January 2008, the Company purchased Auction Rate Securities ("ARS") investment held with UBS AG ("UBS"), one of the Company’

s

investment providers. Since inception in 2008 and due to uncertainties in the credit markets, all scheduled auctions began to fail and the

investments were illiquid resulting in Level 3 financial asset classification. In November 2008, the Company accepted an offer (the “Right”

)

from UBS entitling the Company to sell at par value ARS purchased from UBS at anytime during a two-

year period from June 30, 2010 through

July 2, 2012. On June 30, 2010, the Company exercised the Right to liquidate its remaining ARS investments at par value. On July 1, 2010, that

transaction was executed and the Company received proceeds of $26.3 million, which were immediately invested in Treasury securities. As of

December 31, 2010, the Company only held Level 1 financial assets which were all invested in money market funds, primarily in U.S. Treasury

and U.S. agency securities.

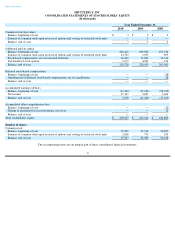

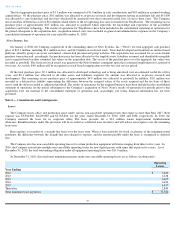

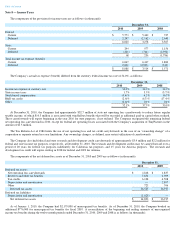

The following table provides a summary of activity related to the Company’s ARS investments and the Right (in thousands):

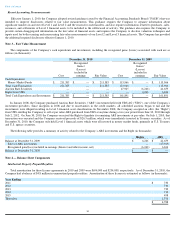

Note 4 — Balance Sheet Components

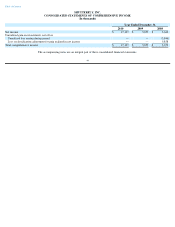

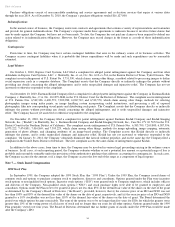

Intellectual Property Prepaid Royalties

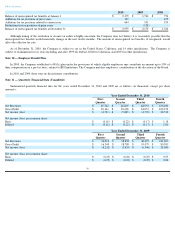

Total amortization for these license agreements in 2010 and 2009 were $694,000 and $234,000, respectively. As of December 31, 2010, the

Company had a balance of $4.8 million in unamortized prepaid royalties. Amortization of these licenses is estimated as follows (in thousands):

Table of Contents

December 31, 2010

December 31, 2009

Cost

Recognized

Gains /

(Losses)

included in

earnings

Fair Value

Cost

Recognized

Gains /

(Losses)

included in

earnings

Fair Value

Cash Equivalents

Money Market Funds

$

211,385

$

—

$

211,385

$

113,966

$

—

$

113,966

Total Cash Equivalents

211,385

—

211,385

113,966

—

113,966

Auction Rate Securities

—

—

—

47,925

(6,266

)

41,659

Rights from UBS

—

—

—

—

6,266

6,266

Total Cash Equivalents and Investments

$

211,385

$

—

$

211,385

$

161,891

$

—

$

161,891

Rights

ARS

Balance at December 31, 2009

$

6,266

$

41,659

Sales of ARS investments

—

(

47,925

)

Recognized gain/(loss) included in earnings (Interest and other income, net)

(6,266

)

6,266

Balance at December 31, 2010

$

—

$

—

Year Ending:

2011

$

730

2012

730

2013

730

2014

730

2015

498

Thereafter

1,370

$

4,788

50