Sharp 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Annual Report 2011

Financial Section

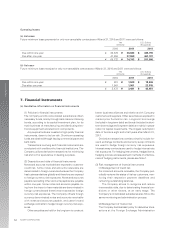

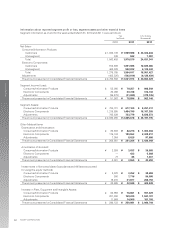

(d) Amount of Generated Goodwill, Reason for Generation

of Goodwill, Goodwill Amortization Method and Period

(1) Amount of Generated Goodwill

¥15,403 million ($187,841 thousand)

(2) Reason for Generation of Goodwill

Revenue surplus to be expected as a result of busi-

ness expansion in the future

(3) Goodwill Amortization Method and Period

Equal amortization over ten (10) years

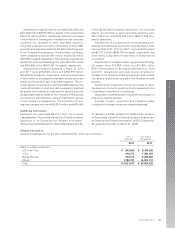

control of Recurrent Energy, LLC will enable the

Company and its consolidated subsidialies to function

as a developer in the photovoltaic field through this

acquisition, and further expand its business in this area.

(3) Date of Business Combination

November 4, 2010

(4) Legal Form of Business Combination

Acquisition of equity for cash consideration

(5) Corporate Name after Combination

Recurrent Energy, LLC

(6) Ratio of Acquired Voting Rights

Ratio of Voting Rights after Acquisition of Equity 100%

(7) Main Reason for deciding Acquiring Company

Sharp US Holding Inc., the Company’s wholly owned

subsidiary, acquired equity of Recurrent Energy, LLC

for cash consideration.

(b) Period of Operating Performance of the Acquired

Company included in Consolidated Financial Statements

From January 1, 2011 to March 31, 2011

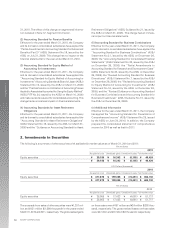

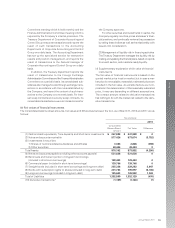

Consideration for the acquisition: amount of investment in

Recurrent Energy, LLC as of the date of business combination

Other costs directly incurred for the acquisition

Total Acquisition Costs

Yen

(millions)

¥ 24,820

230

¥ 25,050

$ 302,683

2,805

$ 305,488

U.S. Dollars

(thousands)

(c) Details of the Acquisition Costs for Acquired Company

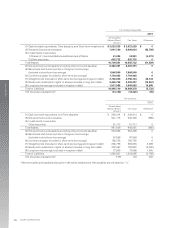

Current Assets

Non-Current Assets

Total Assets

Current Liabilities

Long-term Liabilities

Total Liabilities

Yen

(millions)

¥ 875

14,827

¥ 15,702

3,939

2,543

¥ 6,482

$ 10,671

180,817

$ 191,488

48,037

31,012

$ 79,049

U.S. Dollars

(thousands)

(e) Amount of Assets Accepted and Liabilities Assumed on the Date of Business Combination and their Details

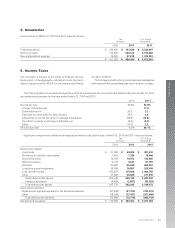

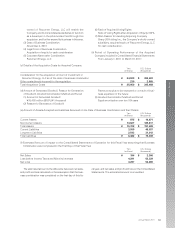

Net Sales

Loss before Income Taxes and Minority Interests

Net Loss

Yen

(millions)

¥ 194

4,291

4,287

$ 2,366

52,329

52,280

U.S. Dollars

(thousands)

(f) Estimated Amount of Impact on the Consolidated Statements of Operation for this Fiscal Year assuming that Business

Combination was Completed on the First Day of this Fiscal Year

The estimated amount is the difference between net sales,

and profit and loss calculated on the assumption that the busi-

ness combination was completed on the first day of this fis-

cal year, and net sales, and profit and loss on the Consolidated

Statements. The estimated amount is un-audited.