Sharp 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

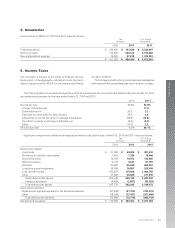

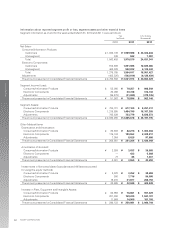

Consolidated

Balance Sheet

Amount

55

Annual Report 2011

Financial Section

2011

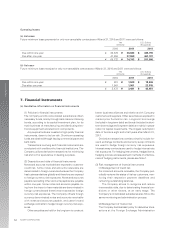

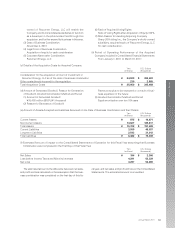

(b) Fair values of financial instruments

Committee meeting which is held monthly and the

Finance Administration Committee meeting which is

required by the Company’s internal procedure. The

Treasury Department of Corporate Accounting and

Control Group executes transactions and reports the

result of such transactions to the Accounting

Department of Corporate Accounting and Control

Group on a daily basis. The Accounting Department

has set up the specialized section for transaction

results and position management, and reports the

result of transactions to the General manager of

Corporate Accounting and Control Group on a daily

basis.

In addition, the Treasury Department reports the

result of transactions to the Foreign Exchange

Administration Committee and the Finance Administration

Committee on a periodic basis. Its consolidated sub-

sidiaries also manage forward foreign exchange trans-

actions in accordance with the rules established by

the Company, and report the content of such trans-

actions to the Company on a monthly basis. For inter-

est swap contracts and currency swap contracts, its

consolidated subsidiaries execute transactions after

the Company approves.

For other securities and investments in capital, the

Company regularly monitors prices and issuer’s finan-

cial positions, and continually reviews the possession

by taking these indices as well as the relationship with

issuers into consideration.

[3] Management of liquidity risk in financing activities

The Treasury Department manages the liquidity risk by

making and updating the financial plans, based on reports

from each section, and maintains ready liquidity.

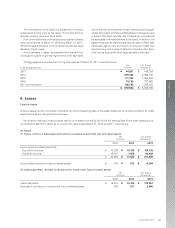

(4) Supplementary explanation of fair value of financial

instruments

The fair value of financial instruments is based on the

quoted market price in active market, but in case a mar-

ket price is not available, reasonably estimated prices are

included in the fair value. As variable factors are incor-

porated in the determination of this reasonably estimated

price, it may vary depending on different assumptions.

The contract amount related to derivative transactions

has nothing to do with the market risk related to the deriv-

ative transactions.

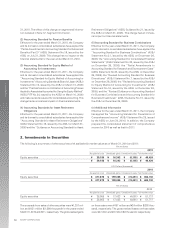

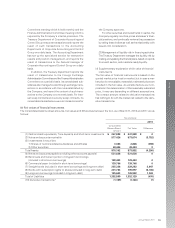

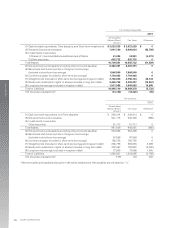

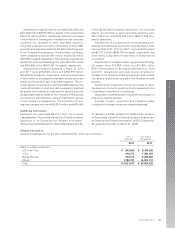

The consolidated balance sheet amounts, fair values and differences between the two, as of March 31, 2010 and 2011 are as

follows:

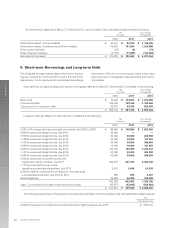

(1) Cash and cash equivalents, Time deposits, and Short-term investments

(2) Notes and accounts receivable

(3) Investments in securities

1) Shares of nonconsolidated subsidiaries and affiliates

2) Other securities

Total Assets

(4) Notes and accounts payable (excluding other accounts payable)

(5) Bank loans and Current portion of long-term borrowings

(included in short-term borrowings)

(6) Commercial paper (included in short-term borrowings)

(7) Straight bonds (included in short-term borrowings and long-term debt)

(8) Bonds with subscription rights to shares (included in long-term debt)

(9) Long-term borrowings (included in long-term debt)

Total of Liabilities

(10) Derivative transactions*

Yen (millions)

DifferenceFair Value

¥0

(3,752)

(498)

0

(4,250)

0

0

0

3,947

(5,786)

1,369

(470)

(7)

¥ 247,888

573,674

2,866

49,424

873,852

531,638

128,453

139,766

229,283

195,997

126,992

1,352,129

(1,166)

¥ 247,888

577,426

3,364

49,424

878,102

531,638

128,453

139,766

225,336

201,783

125,623

1,352,599

(1,159)