Sharp 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Annual Report 2011

Financial Section

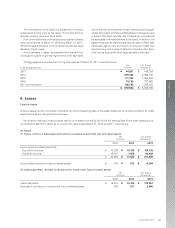

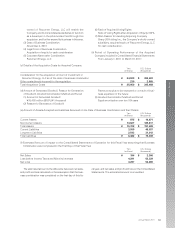

(Note 1) Methods of Calculating the Fair Value of Financial

Instruments and Matters Related to Securities and

Derivative Transactions

(1) Cash and cash equivalents, Time deposits, and

Short-term investments

The fair value of time deposits and Short-term invest-

ments approximates their book value, due to their

short maturity periods.

(2) Notes and accounts receivable

The fair value of notes and accounts receivable due

within a year, approximates their book value. The

fair value of notes and accounts receivable with

long maturity periods is discounted using a rate

which reflects both the period until maturity and

credit risk.

(3) Investments in securities

The fair value of investments in securities is based

on average quoted market prices for the last month

of the fiscal year.

(4) Notes and accounts payable (excluding other

accounts payable)

The fair value of notes and accounts payable

(excluding other accounts payable) approximates

their book value, due to their short maturity peri-

ods.

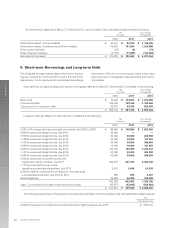

(5) Bank loans and current portion of long-term bor-

rowings (included in short-term borrowings)

The fair value of bank loans and current portion of

long-term borrowings approximates their book

value, due to their short maturity periods.

(6) Commercial paper (included in short-term borrow-

ings)

The fair value of commercial paper approximates

their book value, due to their short maturity periods.

(7) Straight bonds (included in short-term borrowings

and long-term debt)

The fair value of marketable straight bonds is deter-

mined by the quoted market price. The fair value

of non-marketable straight bonds is based on quot-

ed prices from financial institutions.

(8) Bonds with subscription rights to shares (included

in long-term debt)

The fair value of marketable bonds with subscrip-

tion rights to shares is determined by the quoted

market prices. The fair value of non-marketable

bonds with subscription rights to shares is based

on quoted prices from financial institutions.

(9) Long-term borrowings (included in long-term debt)

The fair value of long-term borrowings is deter-

mined by the total amount of the principal and inter-

est using the rate which would apply if similar

borrowings were newly made.

(10) Derivative transactions

The fair value of currency swap contracts and inter-

est swap contracts is based on quoted prices from

financial institutions. The fair value of forward

exchange contracts are based on forward exchange

rate.

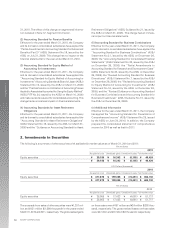

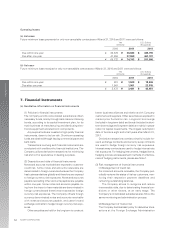

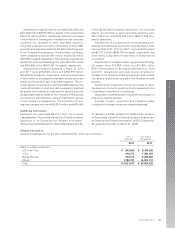

(Note 2) As unlisted stocks ¥39,487 million as of March 31,

2010 and ¥36,567 million ($445,939 thousand) as

of March 31, 2011 and equity ¥371 million as of

March 31, 2010 and ¥8,477 million ($103,378 thou-

sand) as of March 31, 2011 have no quoted market

price and as it is not possible to accurately estimate

future cash flows, it is very difficult to determine

their fair value reasonably. Therefore, they are not

included in “(3) Investments in securities.”

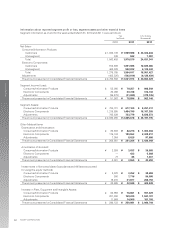

(Note 3) Maturity analysis for Cash and cash equivalents, Time deposits, and Short-term investments, and Notes and

accounts receivable.

Due in one

year or less

2011

Cash and cash equivalents, Time deposits, and Short-term investments

Notes and accounts receivable

Total

Yen (millions)

Due after

one year

¥—

49,323

¥ 49,323

¥ 247,888

528,103

¥ 775,991

Due in one

year or less

2011

Cash and cash equivalents, Time deposits, and Short-term investments

Notes and accounts receivable

Total

U.S. Dollars (thousands)

Due after

one year

$—

601,500

$ 601,500

$ 3,023,025

6,440,280

$ 9,463,305