Sharp 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Sharp Annual Report 2004

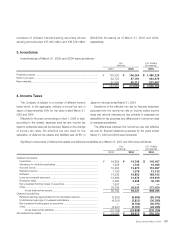

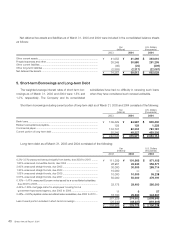

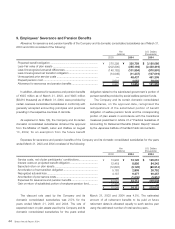

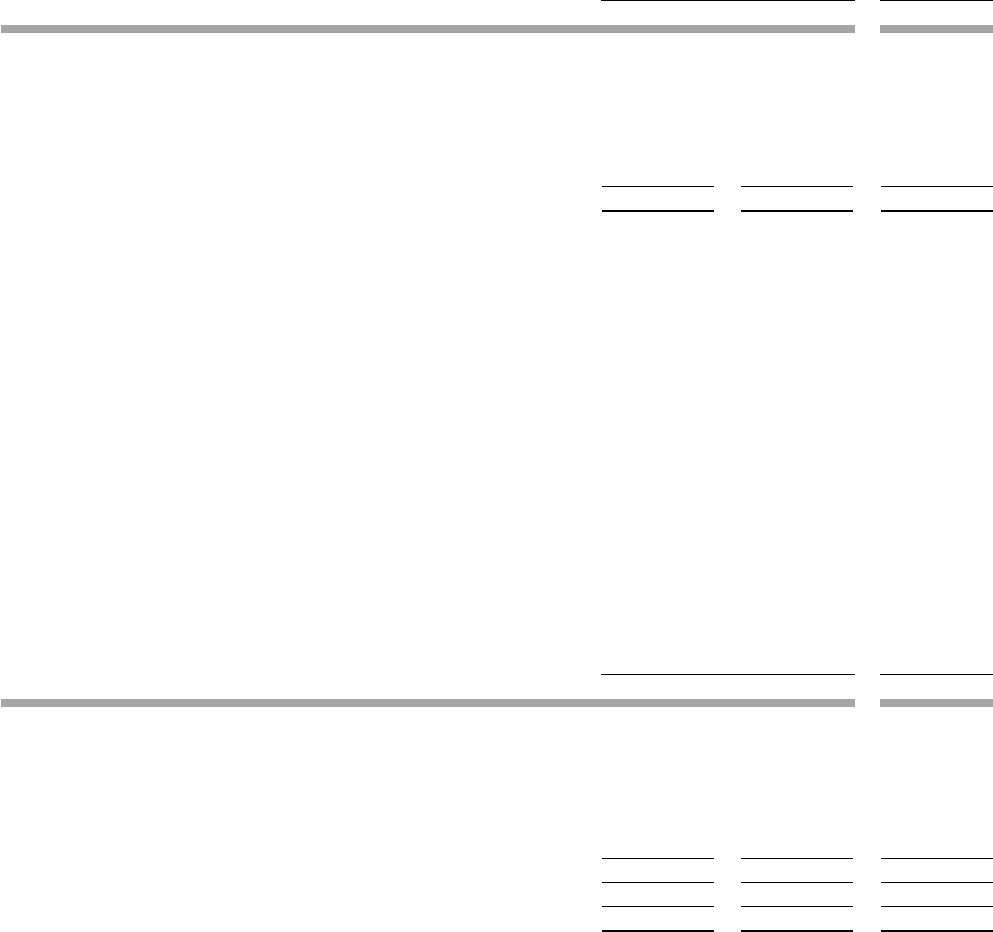

9. Employees’ Severance and Pension Benefits

Allowance for severance and pension benefits of the Company and its domestic consolidated subsidiaries as of March 31,

2003 and 2004 consisted of the following:

Projected benefit obligation ......................................................................

Less-Fair value of plan assets ...........................................................

Less-Unrecognized actuarial differences ...........................................

Less-Unrecognized net transition obligation ......................................

Unrecognized prior service costs ......................................................

Prepaid pension cost ........................................................................

Allowance for severance and pension benefits ..................................

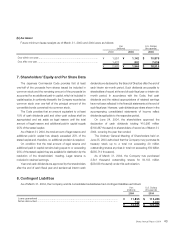

In addition, allowance for severance and pension benefits

of ¥935 million as of March 31, 2003, and ¥925 million

($8,810 thousand) as of March 31, 2004, were provided by

certain overseas consolidated subsidiaries in conformity with

generally accepted accounting principles and practices

prevailing in the respective countries of domicile.

As explained in Note 1(K), the Company and its certain

domestic consolidated subsidiaries obtained the approval

from the Minister of Health, Labor and Welfare on August

13, 2002, for an exemption from the future benefit

obligation related to the substituted government’s portion of

pension benefits provided by social welfare pension funds.

The Company and its certain domestic consolidated

subsidiaries, on the approval date, recognized the

relinquishment of the substituted portion of benefit

obligation of welfare pension funds and the corresponding

portion of plan assets in accordance with the transitional

measures prescribed in Article 47-2 "Practical Guidelines of

Accounting for Retirement Benefits (Interim Report)" issued

by the Japanese Institute of Certified Public Accountants.

$ 3,150,086

(2,430,419)

(970,991)

(107,019)

461,305

38,600

$ 141,562

¥ 330,759

(255,194)

(101,954)

(11,237)

48,437

4,053

¥ 14,864

¥ 370,398

(202,800)

(148,162)

(14,046)

—

3,601

¥ 8,991

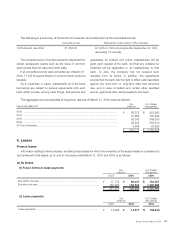

Service costs, net of plan participants’ contributions .........................

Interest costs on projected benefit obligation ....................................

Expected return on plan assets.........................................................

Amortization of net transition obligation .............................................

Recognized actuarial loss ...................................................................

Amortization of prior service costs.......................................................

Expenses for severance and pension benefits...................................

Gain on return of substituted portion of employee pension fund............

$ 125,010

84,343

(86,914)

26,752

90,257

(9,810)

229,638

—

$ 229,638

¥ 13,126

8,856

(9,126)

2,809

9,477

(1,030)

24,112

—

¥ 24,112

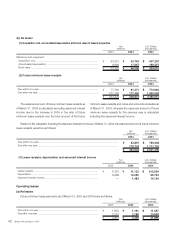

The discount rate used by the Company and its

domestic consolidated subsidiaries was 2.5% for the

years ended March 31, 2003 and 2004. The rate of

expected return on plan assets used by the Company and its

domestic consolidated subsidiaries for the years ended

March 31, 2003 and 2004 was 4.5%. The estimated

amount of all retirement benefits to be paid at future

retirement dates is allocated equally to each service year

using the estimated number of total service years.

20042004

Yen

(millions) U.S. Dollars

(thousands)

200420042003

Yen

(millions) U.S. Dollars

(thousands)

¥ 13,938

12,419

(12,697)

5,163

4,187

—

23,010

(7,961)

¥ 15,049

2003

Expenses for severance and pension benefits of the Company and its domestic consolidated subsidiaries for the years

ended March 31, 2003 and 2004 consisted of the following: