Sharp 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sharp Annual Report 2004 41

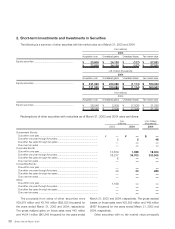

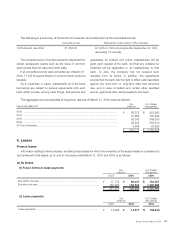

The following is a summary of the terms of conversion and redemption of the convertible bonds:

1.60% Bonds, due 2004 ¥1,554.00 At 106% to 100% of principal after September 30, 1997,

decreasing 1% annually

Redemption at the option of the CompanyConversion price

The conversion price of bonds is subject to adjustment for

certain subsequent events such as the issue of common

stock at less than fair value and stock splits.

If all convertible bonds were converted as of March 31,

2004, 17,335 thousand shares of common stock would be

issuable.

As is customary in Japan, substantially all of the bank

borrowings are subject to general agreements with each

bank which provide, among other things, that security and

guarantees for present and future indebtedness will be

given upon request of the bank, and that any collateral so

furnished will be applicable to all indebtedness to that

bank. To date, the Company has not received such

requests from its banks. In addition, the agreements

provide that the bank has the right to offset cash deposited

against any short-term or long-term debt that becomes

due, and in case of default and certain other specified

events, against all other debts payable to the bank.

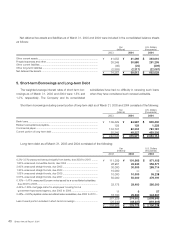

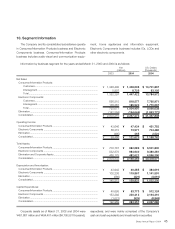

The aggregate annual maturities of long-term debt as of March 31, 2004 were as follows:

2006 ............................................................................................................................................

2007 ............................................................................................................................................

2008 ............................................................................................................................................

2009 ............................................................................................................................................

2010 and thereafter......................................................................................................................

$ 822,590

145,409

849,000

252,610

80,629

$ 2,150,238

¥ 86,372

15,268

89,145

26,524

8,466

¥ 225,775

U.S. Dollars

(thousands)

Yen

(millions)

Year ending March 31

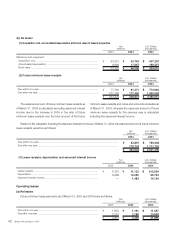

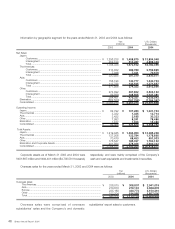

Lease payments ............................................................................................ $ 138,829 ¥ 14,577 ¥ 14,496

(2) Lease payments

6. Leases

Finance leases

(a) As lessee

(1) Future minimum lease payments

Due within one year .......................................................................................

Due after one year .........................................................................................

$ 762,257

1,490,686

$ 2,252,943

¥ 80,037

156,522

¥ 236,559

¥ 77,772

149,904

¥ 227,676

200420042003

Yen

(millions) U.S. Dollars

(thousands)

200420042003

Yen

(millions) U.S. Dollars

(thousands)

Information relating to finance leases, excluding those leases for which the ownership of the leased assets is considered to

be transferred to the lessee, as of, and for the years ended March 31, 2003 and 2004, is as follows: