Sharp 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sharp Annual Report 2004 29

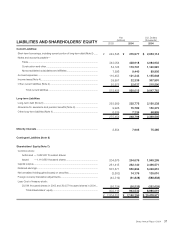

¥84,987 million, commercial paper decreased ¥22,513

million, to ¥82,234 million, and current portion of long-

term debt increased ¥19,987 million, to ¥48,227 million.

Notes and accounts payable were ¥558,119 million, an

increase of ¥153,641 million, and the ratio against monthly

turnover was 3.0 months.

Long-term liabilities were ¥248,798 million, a decrease of

¥26,656 million from the previous year. This was mainly

due to a decrease of ¥33,214 million in long-term debt,

which outweighed an increase of ¥5,863 million in

allowance for severance and pension benefits. The

decrease in long-term debt was primarily attributable to

the transfer of current portion of long-term debt to short-term

borrowings.

Interest-bearing debt decreased ¥60,182 million, to

¥441,223 million.

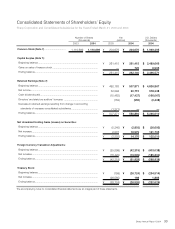

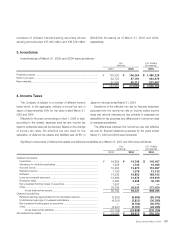

[Shareholders’ Equity]

Retained earnings increased ¥43,023 million over the

previous year, to ¥550,894 million, mainly due to the

increase in net income. Net unrealized holding gains on

securities increased ¥16,979 million due to higher stock

prices. Despite a loss of ¥19,509 million in foreign currency

translation adjustments during the fiscal year, total share-

holders’ equity increased ¥41,416 million over the previ-

ous year, to ¥943,532 million, while the equity ratio was

43.9%.

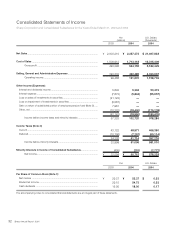

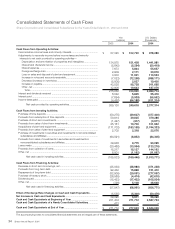

Cash Flows

Cash and cash equivalents at the end of the year were

¥277,623 million, an increase of ¥5,911 million over the

previous year, due to net cash provided by operating

activities, which compensated for the year’s capital invest-

ment and the reduction in interest-bearing debt.

Net cash provided by operating activities decreased

¥19,512 million, to ¥249,618 million, mainly as a result of an

increase of ¥59,708 million in income taxes paid, which

overrode an increase of ¥45,395 million in income before

income taxes and minority interests.

Net cash used in investing activities increased ¥3,613 mil-

lion, to ¥169,446 million, due mainly to an increase of

¥11,452 million in acquisitions of plant and equipment for the

Kameyama Plant and the Mie No. 3 Plant.

Net cash used in financing activities increased ¥11,114

million, to ¥68,961 million, primarily as a result of the

reduction in interest-bearing debt, including short-term

borrowings and commercial paper.

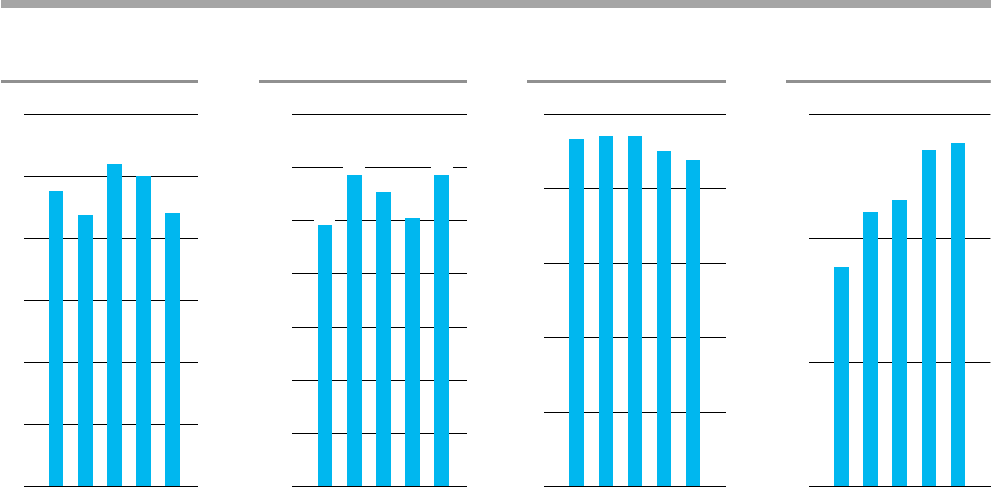

0

10

20

30

40

50

00 01 02 0403

46

.

6

43

.

9

47

.

147

.

1

45

.

0

650

700

750

800

850

900

950

1

,

000

00 01 02 0403

926

902

896

943 943

Percentage of

Shareholders’ Equity

Shareholders’ Equity

00 01 02 0403

476

441

438

519 501

0

100

200

300

400

500

600

Interest-Bearing Debt

00 01 02 0403

177

277

221 231

271

0

100

200

300

Cash and Cash

Equivalents

(billions of yen) (billions of yen) (billions of yen)(%)