Seagate 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

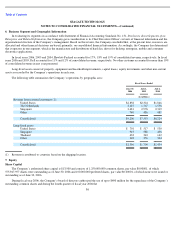

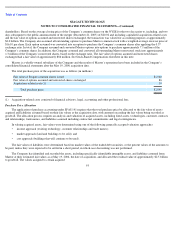

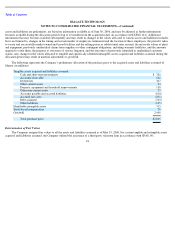

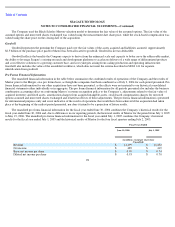

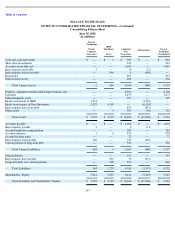

Property, equipment and leasehold improvements

In general, plant and equipment that will continue to be used is valued at current replacement cost for similar capacity while plant and

equipment to be sold or held and not used, is valued at fair value less cost to sell. Land and buildings are valued using the replacement cost

approach if they will continue to be used or the market approach if they will be sold. The following table summarizes the estimated fair value

of the property, plant and equipment and leasehold improvements acquired from Maxtor and their estimated useful lives:

Inventories

Estimated Fair

Value

Estimated Weighted-

Average Remaining

Useful Life

(in years)

($ in millions)

Land

$

8

N/A

Equipment

71

2

Building and leasehold improvements

59

41

Total property, equipment and leasehold improvements

$

138

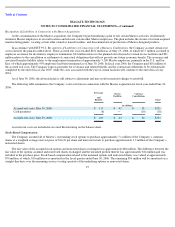

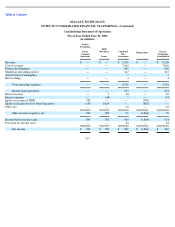

The Company allocated $347 million of the purchase price to inventories acquired. Finished goods and work-in-process inventories were

valued based on the Income Method, which is based on the projected cash flows derived from selling the finished goods inventory, adjusted for

costs of disposition and the profit commensurate with the amount of investment and degree of risk, and in the case of the work-in-process, also

the expected costs of completion. Raw materials are valued based on the Replacement Cost Method. The recorded fair values of the inventories

are charged to Cost of Revenue as the inventories are sold.

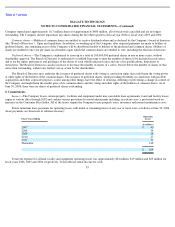

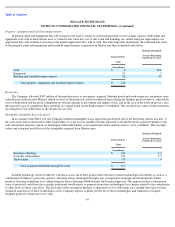

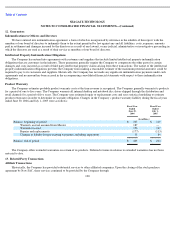

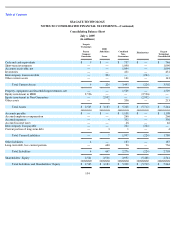

Identifiable Intangible Assets Acquired

In accordance with SFAS 141, the Company identified intangible assets apart from goodwill if one of the following criteria was met: 1)

the asset arises from contractual or other legal rights; or 2) the asset is capable of being separated or divided from the acquired enterprise and

sold, transferred, licensed, rented, or exchanged, either individually or in conjunction with a related contract, asset, or liability. The recorded

values and estimated useful lives of the intangibles acquired from Maxtor were:

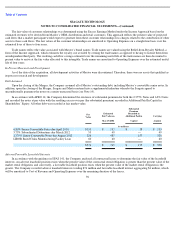

Existing technology relates to Maxtor’s products across all of their product lines that have reached technological feasibility as well as a

combination of Maxtor’s processes, patents, and trade secrets developed through years of experience in design and development of their

products. Existing technology was valued using the Excess Earnings Method under the Income Approach. This approach reflects the present

value of projected cash flows that a market participant would expect to generate from these technologies less charges related to the contribution

of other assets to those cash flows. The fair value of the existing technology is amortized to Cost of Revenue on a straight-line basis over the

estimated useful lives of these technologies as the Company expects to phase out the use of these technologies and transition to Seagate-

designed products within one to two years.

95

Estimated Fair

Value

Estimated Weighted-

Average Remaining

Useful Life (in years)

($ in millions)

Existing technology

$

143

1.4

Customer relationships

139

3.5

Trade names

33

4

Total acquired identifiable intangible assets

$

315