Seagate 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

2006 was attributable to the addition of deferred tax assets associated with the Maxtor and other 2006 acquisitions, the benefit of which will be

recorded as a reduction to goodwill when, and if, realized. This increase is offset by a decrease of approximately $145 million in deferred tax

assets relating to U.S. income tax benefits of stock option deductions, the benefit of which will be credited to additional paid-in capital, when

and if realized, that were derecognized as a result of the adoption of FAS 123(R). The remaining change in valuation allowance of

approximately $48 million relates to other net increases in the Company’s gross deferred tax assets.

At June 30, 2006, the Company had U.S. federal, state and foreign tax net operating loss carryforwards of approximately $1.9 billion,

$868 million and $381 million, respectively, which will expire at various dates beginning in 2008 if not utilized. At June 30, 2006, the

Company had U.S. tax credit carryforwards of $197 million, which will expire at various dates beginning in 2007, if not utilized. These net

operating losses and tax credit carryforwards have not been audited by the relevant tax authorities and could be subject to adjustment on

examination.

As a result of the Maxtor acquisition, Maxtor underwent a change in ownership within the meaning of Section 382 of the Internal

Revenue Code (IRC Sec. 382) on May 19, 2006. In general, IRC Section 382 places annual limitations on the use of certain tax attributes such

as net operating losses and tax credit carryovers in existence at the ownership change date. As of June 30, 2006, approximately $1.4 billion and

$378 million of U.S. federal and state net operating losses, respectively, and $39 million of tax credit carryovers acquired from Maxtor are

generally subject to an annual limitation of approximately $110 million. Certain amounts may be accelerated into the first five years following

the acquisition pursuant to IRC Section 382 and published notices.

On January 3, 2005, the Company underwent a change in ownership under IRC Section 382 due to the sale of common shares to the

public by its then largest shareholder, New SAC. Based on an independent valuation as of January 3, 2005, the annual limitation for this change

is $44.8 million. As of June 30, 2006, there are $447 million of U.S. net operating loss carryforwards and $111 million of U.S. tax credit

carryforwards subject to IRC Section 382 limitation associated with the January 3, 2005 change. To the extent management believes it is more

likely than not that the deferred tax assets associated with tax attributes subject to IRC Section 382 limitations will not be realized, a valuation

allowance has been provided.

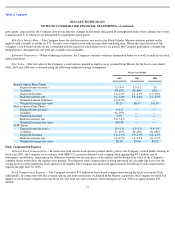

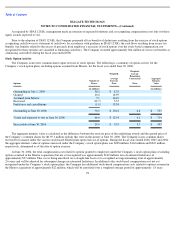

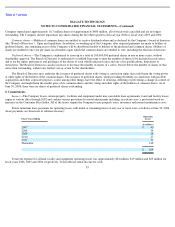

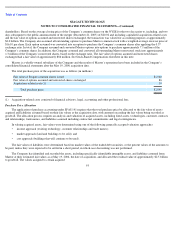

The applicable statutory rate in the Cayman Islands was zero for the Company for fiscal years ended June 30, 2006, July 1, 2005 and

July 2, 2004. For purposes of the reconciliation between the provision for (benefit from) income taxes at the statutory rate and the effective tax

rate, a notional U.S. 35% rate is applied as follows:

83

Fiscal Year

Ended

June 30,

2006

Fiscal Year

Ended

July 1,

2005

Fiscal Year

Ended

July 2,

2004

(in millions)

Provision at U.S. notional statutory rate

$

323

$

256

$

150

State income tax provision (benefit), net of U.S. notional income tax benefit

7

3

—

Reversal of accrued income taxes

—

VERITAS indemnification

—

—

(

125

)

Reduction in previously accrued foreign income taxes

(2

)

(13

)

—

Valuation allowance

65

11

13

Use of current year U.S. tax credit

(11

)

(16

)

—

Foreign earnings not subject to U.S. notional income tax

(309

)

(216

)

(139

)

Other individually immaterial items

11

—

—

Provision for (benefit from) income taxes

$

84

$

25

$

(101

)