Seagate 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Dividends to New SAC

During fiscal year 2006, pursuant to its quarterly dividend policy, the Company paid dividends to its shareholders aggregating

approximately $155 million, or $0.32 per share, including New SAC. As of January 3, 2006, New SAC had distributed substantially all of the

common shares of the Company that it held to its shareholders, and New SAC no longer owns any of the Company’s common shares.

During fiscal year 2005, pursuant to its quarterly dividend policy, the Company paid dividends to its shareholders aggregating

approximately $122 million, or $0.26 per share. Of the $122 million paid, New SAC received approximately $60 million. New SAC in turn

distributed the $60 million it received to its ordinary shareholders, including approximately $10 million paid to officers and employees of the

Company who held ordinary shares of New SAC.

During fiscal year 2004, pursuant to its quarterly dividend policy, the Company paid dividends to its shareholders aggregating

approximately $90 million. Of the $90 million paid, New SAC received approximately $57 million. New SAC in turn distributed the $57

million it received to its ordinary shareholders, including approximately $11 million paid to officers and employees of the Company who held

ordinary shares of New SAC.

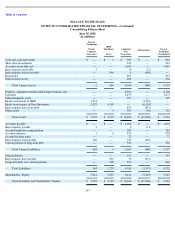

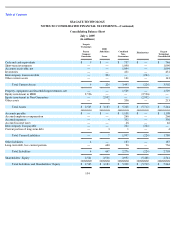

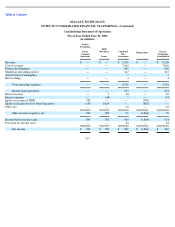

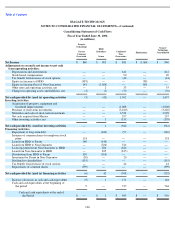

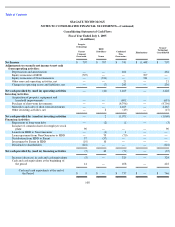

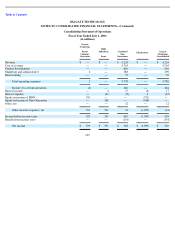

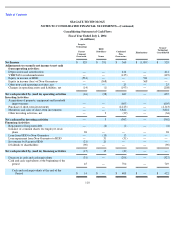

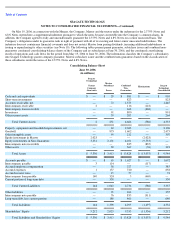

14. Condensed Consolidating Financial Information

On May 13, 2002, Seagate Technology HDD Holdings, or HDD, issued $400 million in aggregate principal amount of 8% Notes. HDD is

the Company’s wholly-owned direct subsidiary, and the Company has guaranteed HDD’s obligations under the 8% Notes, on a joint and

several, full and unconditional basis. The following tables present parent guarantor, subsidiary issuer and combined non-guarantors condensed

consolidating balance sheets of the Company and its subsidiaries at June 30, 2006 and July 1, 2005 and the condensed consolidating results of

operations and cash flows for the fiscal years ended June 30, 2006, July 1, 2005 and July 2, 2004. The information classifies the Company’s

subsidiaries into Seagate Technology (parent company guarantor), HDD (subsidiary issuer), and the combined non-guarantors based upon the

classification of those subsidiaries under the terms of the 8% Notes. The Company is restricted in its ability to obtain funds from its

subsidiaries by dividend or loan under both the indenture governing the 8% Notes and the credit agreement governing its revolving credit

facility. Under this instrument, dividends paid by HDD or its restricted subsidiaries would constitute restricted payments, and loans between

the Company and HDD or its restricted subsidiaries would constitute affiliate transactions.

From the date of acquisition (May 19, 2006) through June 30, 2006, Maxtor was a wholly owned direct subsidiary of Seagate

Technology. The accompanying condensed consolidating financial information reflects the corporate legal structure of Seagate Technology,

HDD, and the Combined Non-Guarantors, as they existed as of June 30, 2006. On July 3, 2006, through a corporate organizational change and

realignment, Maxtor became a wholly owned indirect subsidiary of HDD and of Seagate Technology. As a result, beginning July 3, 2006, the

operating results of Maxtor will be included in the results of HDD on an equity method basis. In addition, going forward the balance sheet of

HDD will reflect the investment in Maxtor on an equity method basis.

102