Seagate 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

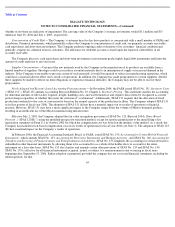

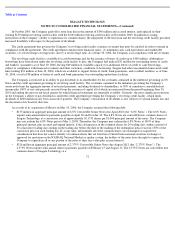

In accordance with the provisions of Statement of SFAS No. 141, Business Combinations (“SFAS 141”), the purchase price of an

acquired company is allocated between tangible and intangible assets acquired and liabilities assumed from the acquired business based on

their estimated fair values, with the residual of the purchase price recorded as goodwill. The Company engages third-party appraisal firms to

assist management in determining the fair values of certain assets acquired and liabilities assumed. Such valuations require management to

make significant judgments, estimates and assumptions, especially with respect to intangible assets. Management makes estimates of fair value

based upon assumptions it believes to be reasonable. These estimates are based on historical experience and information obtained from the

management of the acquired companies, and are inherently uncertain. Critical estimates in valuing certain of the intangible assets include but

are not limited to: future expected cash flows from and economic lives of existing technology, customer relationships, trade names, and other

intangible assets; and discount rates. Unanticipated events and circumstances may occur which may affect the accuracy or validity of such

assumptions, estimates or actual results.

The Company is required to periodically evaluate the carrying values of intangible assets for impairment. If any of the Company’s

intangible assets are determined to be impaired, the Company may have to write-down the impaired asset and its earnings would be adversely

impacted in the period that occurs.

At June 30, 2006, the Company’s goodwill totaled approximately $2.5 billion and our identifiable intangible assets totaled $307 million.

In accordance with the provisions of SFAS 142, Goodwill and Other Intangible Assets (“SFAS 142), the Company assesses the impairment of

goodwill at least annually, or more often if warranted by events or changes in circumstances indicating that the carrying value may exceed its

fair value. This assessment requires the projection and discounting of cash flows, analysis of the Company’s market capitalization and

estimating the fair values of tangible and intangible assets and liabilities. Estimating future cash flows and determining their present values are

based upon, among other things, certain assumptions about expected future operating performance and appropriate discount rates determined

by management. The Company’s estimates of cash flows may differ from actual cash flows due to, among other things, economic conditions,

changes to the business model, or changes in operating performance. Significant differences between these estimates and actual cash flows

could materially affect the Company’s future financial results.

The Company also has other key accounting policies and accounting estimates relating to uncollectible customer accounts, valuation of

inventory and valuation of share-

based payments (see Note 3). The Company believes that these other accounting policies and other accounting

estimates either do not generally require it to make estimates and judgments that are as difficult or as subjective, or it is less likely that they

would have a material impact on its reported results of operations for a given period.

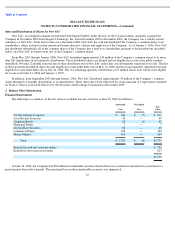

Basis of Presentation and Consolidation —The consolidated financial statements include the accounts of the Company and all its wholly-

owned subsidiaries, after elimination of intercompany transactions and balances. On May 19, 2006, the Company acquired 100% of the

outstanding common stock, stock options and nonvested stock of Maxtor Corporation (“Maxtor”). The consolidated financial statements

include the results of operations of Maxtor subsequent to May 19, 2006.

The Company operates and reports financial results on a fiscal year of 52 or 53 weeks ending on the Friday closest to June 30.

Accordingly, fiscal year 2006 and fiscal year 2005 comprised 52 weeks and ended on June 30, 2006 and July 1, 2005, respectively, while fiscal

year 2004 comprised 53 weeks and ended on July 2, 2004. All references to years in these notes to consolidated financial statements represent

fiscal years unless otherwise noted.

62