Seagate 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

shareholders. Based on the average closing price of the Company’s common shares on the NYSE for the two days prior to, including, and two

days subsequent to the public announcement of the merger (December 21, 2005) of $20.02 and including capitalized acquisition-related costs

and the fair value of options assumed and nonvested shares exchanged, the transaction was valued for accounting purposes at approximately

$2.0 billion. The Company also assumed all outstanding options to purchase Maxtor common stock with a weighted-average exercise price of

$16.10 per share. Each option assumed was converted into an option to purchase the Company’s common shares after applying the 0.37

exchange ratio. In total, the Company assumed and converted Maxtor options into options to purchase approximately 7.1 million of the

Company’s common shares. In addition, the Company assumed and converted all outstanding Maxtor nonvested stock into approximately

1.3 million of the Company’s nonvested shares, based on the exchange ratio. The fair value of options assumed and nonvested shares

exchanged had a fair value of approximately $86 million. See Stock-Based Compensation elsewhere in this note.

Maxtor is a wholly-owned subsidiary of the Company and the results of Maxtor’s operations have been included in the Company’s

consolidated financial statements after the May 19, 2006 acquisition date.

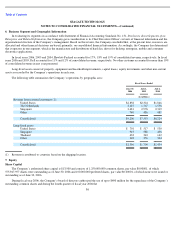

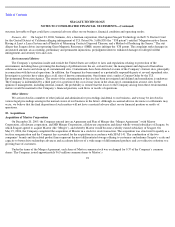

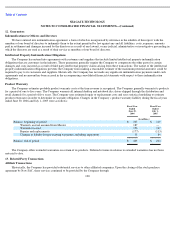

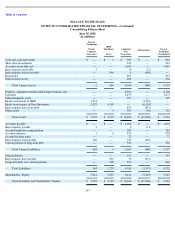

The total purchase price of the acquisition was as follows (in millions):

Purchase Price Allocation

Fair value of Seagate common shares issued

$

1,940

Fair value of options assumed and nonvested shares exchanged

86

Acquisition

-

related costs (1)

19

Total purchase price

$

2,045

(1)

Acquisition

-

related costs consisted of financial advisory, legal, accounting and other professional fees.

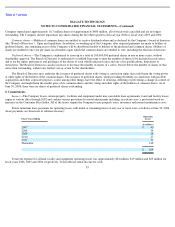

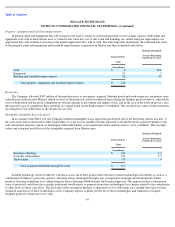

The application of purchase accounting under SFAS 141 requires that the total purchase price be allocated to the fair value of assets

acquired and liabilities assumed based on their fair values at the acquisition date, with amounts exceeding the fair values being recorded as

goodwill. The allocation process requires an analysis and valuation of acquired assets, including fixed assets, technologies, customer contracts

and relationships, trade names, and liabilities assumed including contractual commitments and legal contingencies.

In valuing acquired assets, fair values were determined using one of the following generally accepted valuation approaches:

•

income approach (existing technology, customer relationships and trade names);

•

market approach (land and buildings to be sold); and

The fair values of liabilities were determined based on market values of the traded debt securities, or the present values of the amounts to

be paid, unless they were expected to be settled in a short period, in which case discounting was not performed.

The Company has identified and recorded the assets, including specifically identifiable intangible assets, and liabilities assumed from

Maxtor at their estimated fair values as at May 19, 2006, the date of acquisition, and allocated the residual value of approximately $2.5 billion

to goodwill. The values assigned to certain acquired

93

•

cost approach (buildings that will continue to be used).