Seagate 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

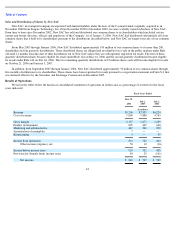

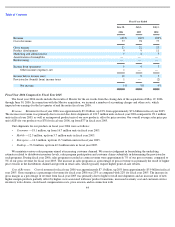

Table of Contents

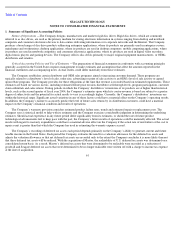

As a result of the Maxtor acquisition, we assumed all debts and liabilities of Maxtor Corporation, together with cash and short-term

investments, and any consolidated indebtedness of Maxtor Corporation outstanding at May 19, 2006, including, without limitation, its

outstanding convertible senior notes, which were consolidated with our indebtedness for financial reporting purposes. Following the

acquisition, we will require additional amounts of cash to fund scheduled payments of principal and interest on Maxtor’s indebtedness, which

could limit our financial flexibility. In addition, Maxtor’s 2.375% Convertible Senior Notes due August 2012, one of the series of notes which

were assumed by Seagate following the acquisition and of which $326 million were outstanding as of June 30, 2006, contain a cash conversion

feature that will require Seagate to deliver the holders, upon any conversion of these notes, cash in an amount equal to the lesser of (a) the

principal amount of the notes converted and (b) the as-

converted value of the notes. To the extent holders of the Maxtor notes choose to convert

their notes following the acquisition, Seagate will require additional amounts of cash to meet this obligation.

In October 2005, our board authorized the use of up to $400 million for the repurchase of our outstanding common shares. During the

quarter ended June 30, 2006, the company repurchased a total of approximately 16.7 million common shares for approximately $400 million,

all of which were retired and therefore not available for reissue. In July 2006, our board of directors approved an additional share repurchase of

up to $2.5 billion of our common shares over the next two years. We expect to fund the share repurchase through a combination of cash on

hand, future cash flow from operations and other sources of financing such as additional debt. Share repurchases under this program may be

made through a variety of methods, which may include open market purchases, privately negotiated transactions, block trades, accelerated

share repurchase transactions or otherwise, or by any combination of such methods. The timing and actual number of shares repurchased will

depend on a variety of factors including the share price, corporate and regulatory requirements, other market and economic conditions and

sources of liquidity. The share repurchase program may be suspended or discontinued at any time.

In addition, as part of our strategy, we may selectively pursue strategic alliances, acquisitions and investments that are complementary to

our business. Any material future acquisitions, alliances or investments will likely require additional capital. We may enter into more of these

types of arrangements in the future, which could also require us to seek additional equity or debt financing. Additional funds may not be

available on terms favorable to us or at all. We will require substantial amounts of cash to fund scheduled payments of principal and interest on

our indebtedness, future capital expenditures, any increased working capital requirements and share repurchases. If we are unable to meet our

cash requirements out of existing cash or cash flow from operations, we cannot assure you that we will be able to obtain alternative financing

on terms acceptable to us, if at all.

We believe that our sources of cash will be sufficient to fund our operations and meet our cash requirements for at least the next 12

months. Our ability to fund these requirements and comply with the financial covenants under our debt agreements will depend on our future

operations, performance and cash flow and is subject to prevailing economic conditions and financial, business and other factors, some of

which are beyond our control.

51