Seagate 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

participants’ expectations, the Company does not incorporate changes in dividends anticipated by management unless those changes have been

communicated to or otherwise are anticipated by marketplace participants.

Risk-Free Interest Rate —The Company bases the risk-free interest rate used in the Black-Scholes-Merton valuation method on the

implied yield currently available on U.S. Treasury zero-coupon issues with an equivalent remaining term. Where the expected term of the

Company’s stock-based awards do not correspond with the terms for which interest rates are quoted, the Company performed a straight-line

interpolation to determine the rate from the available term maturities.

Estimated Forfeitures —

When estimating forfeitures, the Company considers voluntary termination behavior as well as analysis of actual

option forfeitures.

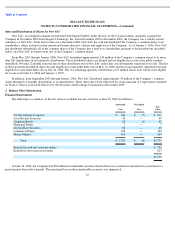

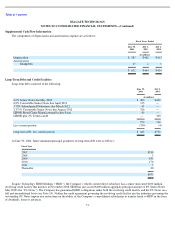

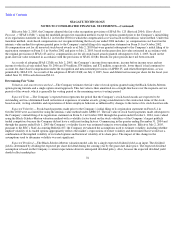

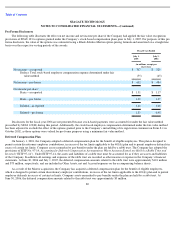

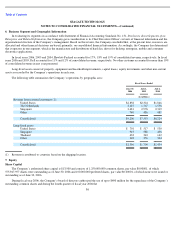

Fair Value —The fair value of the Company’s stock options granted to employees or assumed from Maxtor for the fiscal years ended

2006, 2005 and 2004 were estimated using the following weighted-average assumptions:

Stock Compensation Expense

Fiscal Years Ended

2006

2005

2004

Seagate Option Plans Shares

Expected term (in years)

3.5

–

4.0

3.0

–

3.5

3.0

Volatility

40

–

43%

50

–

80%

80%

Expected dividend

1.2

–

2.3%

1.3

–

2.3%

0.5

–

2.0%

Risk

-

free interest rate

4.1

–

5.0%

2.9

–

3.6%

2.3

–

2.5%

Estimated annual forfeitures

4.6

–

4.9%

—

—

Weighted

-

average fair value

$7.15

$6.55

$11.45

Maxtor Option Plans Shares

Expected term (in years)

0

–

4.8

—

—

Volatility

36

–

39%

—

—

Expected dividend

1.3%

—

—

Risk

-

free interest rate

5.0

–

5.1%

—

—

Weighted

-

average fair value

$10.49

—

—

ESPP Shares

Expected term (in years)

0.5

–

1.0

0.5

–

1.0

0.5

–

1.0

Volatility

37

–

41%

30

–

60%

50

–

100%

Expected dividend

1.2

–

1.7%

1.9

–

2.1%

0.8

–

1.5%

Risk

-

free interest rate

3.6

–

4.5%

1.6

–

2.2%

1.0

–

1.3%

Weighted

-

average fair value

$7.28

$3.86

$4.72

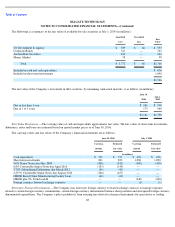

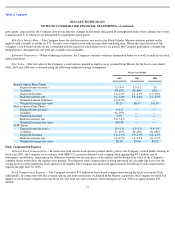

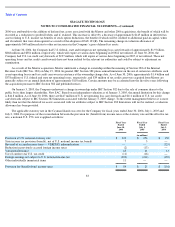

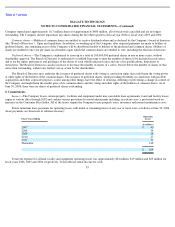

Deferred Stock Compensation —In connection with certain stock options granted shortly prior to the Company’s initial public offering in

fiscal year 2003, the Company, in accordance with APBO 25, recorded deferred stock compensation aggregating $9.7 million, net of

subsequent cancellations, representing the difference between the exercise price of the options and the deemed fair value of the Company’s

common shares on the dates the options were granted. This deferred stock compensation is being amortized on a straight-line basis over the

vesting periods of the underlying stock options of 48 months. The Company has amortized approximately $9 million of such compensation

expense through June 30, 2006.

Stock Compensation Expense —The Company recorded $74 million of stock-based compensation during the fiscal year ended 2006.

Additionally, in connection with the assumed options and nonvested shares exchanged in the Maxtor acquisition, the Company recorded $16

million of stock-based compensation (see Note 10). The total fair value of shares vested during fiscal year 2006 was approximately $75

million.

77