Seagate 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

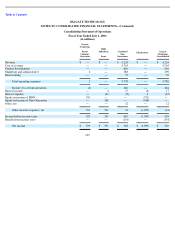

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Other Acquisitions

The Company acquired two other companies for cash in fiscal year 2006 for purchase prices of $15 million and $14 million, respectively,

which resulted in residual values of approximately $12 million and $5 million, respectively, being recorded to goodwill after the allocation of

fair value to tangible and intangible assets acquired and liabilities assumed. These acquisitions did not have a material impact on the

Company’s results of operations.

11. Goodwill and Other Intangible Assets

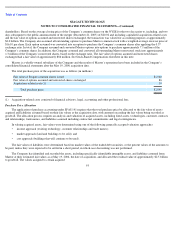

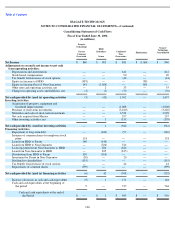

Goodwill

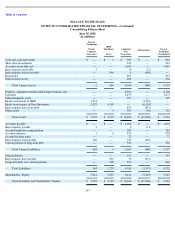

In accordance with SFAS No. 141, the Company allocated the excess of the cost of the acquired entities over the net amounts of assets

acquired and liabilities assumed to goodwill. As at June 30, 2006, the composition of the amounts recorded to goodwill are as follows (in

millions):

In accordance with the guidance in SFAS 142, goodwill will not be amortized. Instead, it will be tested for impairment on an annual basis or

more frequently upon the occurrence of circumstances that indicate that goodwill may be impaired. The Company did not record any

impairment of goodwill during the fiscal year ended June 30, 2006.

Other Intangible Assets

Balance as of July 1, 2005

$

—

Goodwill acquired through the Maxtor acquisition

2,458

Goodwill acquired through other acquisitions

17

Balance as of June 30, 2006

$

2,475

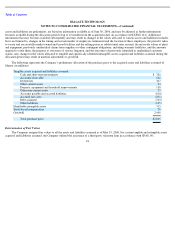

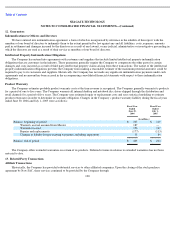

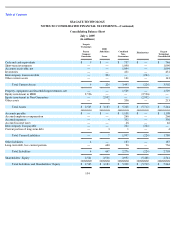

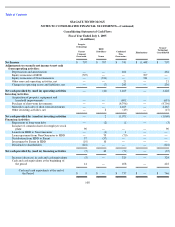

Other intangible assets consist primarily of existing technology, customer relationships and trade names acquired in business

combinations. Acquired intangibles are amortized on a straight-line basis over the respective estimated useful lives of the assets. The carrying

value of intangible assets at June 30, 2006 is set forth in the table below. The carrying value of intangible assets at July 1, 2005 was immaterial.

Accumulated amortization of intangibles was $33 million and $6 million at June 30, 2006 and July 1, 2005, respectively.

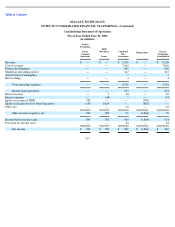

In fiscal years 2006, 2005, and 2004, amortization expense for other intangible assets was $29 million, $2 million, and $1 million,

respectively. Amortization of the existing technology intangible is charged to Cost of revenue while the amortization of the other intangible

assets is included in Operating expenses in the Consolidated Statements of Operations. Aggregate annual amortization of other intangible

assets, based on their current estimated lives, is estimated to be $148 million, $84 million, $51 million and $24 million for fiscal years 2007,

2008, 2009 and 2010, respectively.

99

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

(in millions)

Existing technology

$

150

$

(18

)

$

132

Customer relationships

140

(5

)

135

Trade names

33

(2

)

31

Patents and licenses

17

(8

)

9

Total acquired identifiable intangible assets

$

340

$

(33

)

$

307