Rite Aid 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 28, 2015, March 1, 2014 and March 2, 2013

(In thousands, except per share amounts)

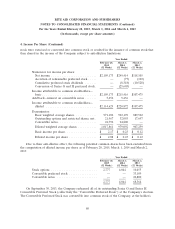

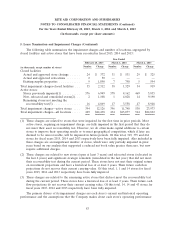

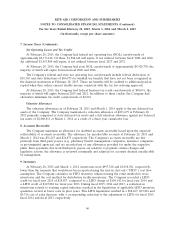

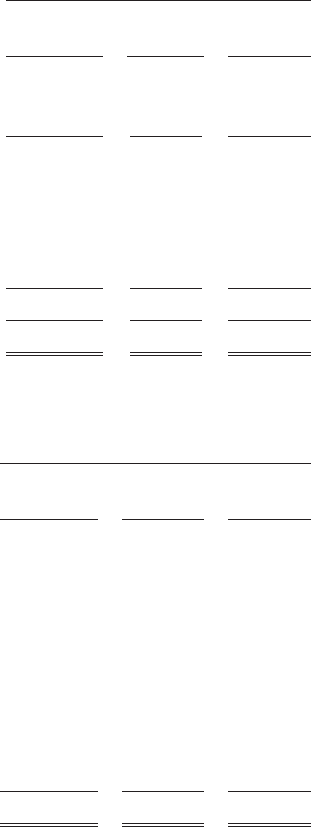

7. Income Taxes

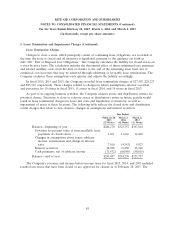

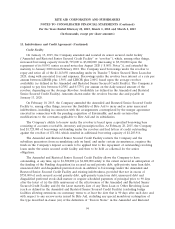

The provision for income tax (benefit) expense was as follows:

Year Ended

February 28, March 1, March 2,

2015 2014 2013

(52 Weeks) (52 Weeks) (52 Weeks)

Current tax:

Federal ............................ $ — $ — $ (6,305)

State .............................. 6,011 4,748 7,928

6,011 4,748 1,623

Deferred tax and other:

Federal ............................ (1,544,344) — (61,544)

State .............................. (144,020) (30,609) (50,679)

Tax expense recorded as an increase of

additional paid-in- capital ............. — 26,665 —

(1,688,364) (3,944) (112,223)

Total income tax (benefit) expense ........ $(1,682,353) $ 804 $(110,600)

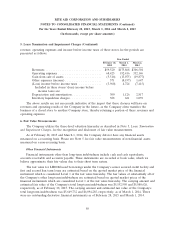

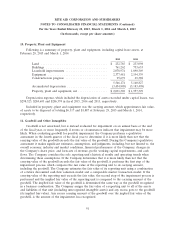

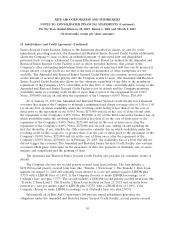

A reconciliation of the expected statutory federal tax and the total income tax (benefit) expense

was as follows:

Year Ended

February 28, March 1, March 2,

2015 2014 2013

(52 Weeks) (52 Weeks) (52 Weeks)

Expected federal statutory expense at 35% . . . $ 149,389 $ 87,576 $ 2,626

Nondeductible expenses ................. 805 857 1,897

State income taxes, net .................. 11,565 44,366 39,470

Decrease of previously recorded liabilities .... (3,698) (21,101) (91,881)

Nondeductible compensation ............. 5,136 44,244 —

Recoverable federal tax due to special 5-year

NOL carryback ...................... — — (6,305)

Release of indemnification asset ........... — 5,941 37,324

Indemnification receipt .................. — — 587

Valuation allowance .................... (1,841,304) (161,079) (94,318)

Other .............................. (4,246) — —

Total income tax (benefit) expense ......... $(1,682,353) $ 804 $(110,600)

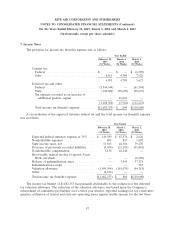

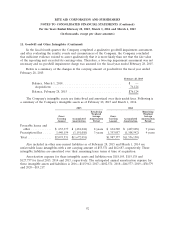

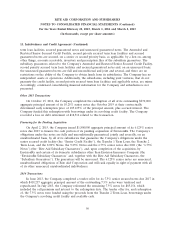

The income tax benefit of $1,682,353 was primarily attributable to the reduction of the deferred

tax valuation allowance. The reduction of the valuation allowance was based upon the Company’s

achievement of cumulative profitability over a three year window, reported earnings for ten consecutive

quarters, utilization of federal and state net operating losses against taxable income for the last three

87