Rite Aid 2015 Annual Report Download - page 30

Download and view the complete annual report

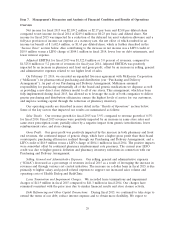

Please find page 30 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.engage in similar efforts in the future. During fiscal 2015 and fiscal 2014, we completed several

refinancing transactions which caused interest expense to decrease by $26.9 million in fiscal 2015. In

January 2015, we amended and restated our senior secured credit facility (‘‘Amended and Restated

Senior Secured Credit Facility’’ or ‘‘revolver’’), which, among other things, increased our borrowing

capacity to $3.0 billion (increasing to $3.7 billion upon the repayment of our 8.00% senior secured

notes (second lien) due August 2020) and extended the maturity to January 2020. We used borrowings

under the revolver to repay and retire all of the $1.144 billion outstanding under our Tranche 7 Senior

Secured Term Loan due 2020. We expect, at current rates, to save approximately $20.0 million in

annual interest expense, based on a $3.0 billion revolver, and approximately $50.0 million in annual

interest expense based on a $3.7 billion revolver and the redemption of our 8.00% senior secured notes

(second lien) due August 2020. In addition, in October 2014, we redeemed our outstanding

$270.0 million aggregate principal amount of 10.25% senior notes due October 2019. These transactions

are described in more detail in the ‘‘Liquidity and Capital Resources’’ section below.

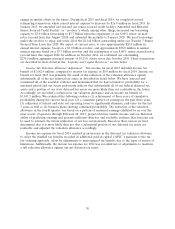

Income Tax Valuation Allowance Adjustment: Net income for fiscal 2015 included income tax

benefit of $1,682.4 million, compared to income tax expense of $0.8 million for fiscal 2014. Income tax

benefit for fiscal 2015 was primarily the result of the reduction of the valuation allowance against

substantially all of the net deferred tax assets as described in detail below. We have assessed and

considered all of the available evidence and determined that we had returned to profitability for a

sustained period and our future projections indicate that substantially all of our federal deferred tax

assets and a portion of our state deferred tax assets are more likely than not realizable in the future.

Accordingly, we recorded a reduction in our valuation allowance and an income tax benefit of

$1,841.3 million. We evaluated the following evidence (1) achievement of three years of cumulative

profitability during the current fiscal year, (2) a consistent pattern of earnings in the past three years,

(3) utilization of federal and state net operating losses to significantly eliminate cash taxes for the last

3 years as well as (4) business plans showing continued profitability. The reduction of the valuation

allowance in the fourth quarter was based on a pattern of sustained earnings exhibited by us over the

most recent 10 quarters through February 28, 2015, projected future taxable income and our historical

ability of predicting earnings and presents sufficient objective and verifiable evidence that forecasts can

be used to estimate the future utilization of our loss carryforwards. Based on these factors we have

determined that it is more likely than not that a substantial portion of our deferred tax assets are

realizable and adjusted the valuation allowance accordingly.

Income tax expense for fiscal 2014 resulted in an increase in the deferred tax valuation allowance

to offset the windfall tax benefits recorded in additional paid-in capital (‘‘APIC’’) pursuant to the tax

law ordering approach, offset by adjustments to unrecognized tax benefits due to the lapse of statute of

limitations. Additionally, the income tax expense for 2014 was recorded net of adjustments to maintain

a full valuation allowance against our net deferred tax assets.

30