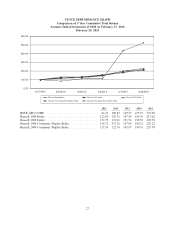

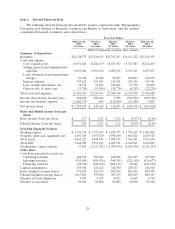

Rite Aid 2015 Annual Report Download - page 29

Download and view the complete annual report

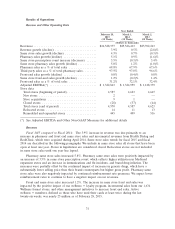

Please find page 29 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

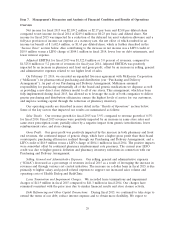

Overview

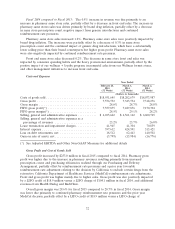

Net income for fiscal 2015 was $2,109.2 million or $2.17 per basic and $2.08 per diluted share

compared to net income for fiscal 2014 of $249.4 million or $0.23 per basic and diluted share. Net

income for fiscal 2015 was impacted by a reduction of the deferred tax asset valuation allowance and a

full year provision of income tax expense at a statutory rate, the net effect of which resulted in an

income tax benefit of $ 1,682.4 million, or $1.65 per diluted share, which is further described in the

‘‘Income Taxes’’ section below. Also contributing to the increase in net income was a LIFO credit of

$18.9 million versus a LIFO charge of $104.1 million in fiscal 2014, lower loss on debt retirements, and

lower interest expense.

Adjusted EBITDA for fiscal 2015 was $1,322.8 million or 5.0 percent of revenues, compared to

$1,325.0 million or 5.2 percent of revenues for fiscal year 2014. Adjusted EBITDA was positively

impacted by an increase in pharmacy and front end gross profit, offset by an increase in selling, general

and administrative expenses related to our higher level of sales.

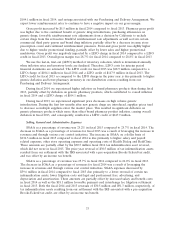

On February 17, 2014, we executed an expanded five-year agreement with McKesson Corporation

(‘‘McKesson’’) for pharmaceutical purchasing and distribution (our ‘‘Purchasing and Delivery

Arrangement’’). As part of our Purchasing and Delivery Arrangement, McKesson assumed

responsibility for purchasing substantially all of the brand and generic medications we dispense as well

as providing a new direct store delivery model to all of our stores. This arrangement, which has been

fully implemented during fiscal 2015, has allowed us to leverage the scale of both companies to deliver

greater purchasing and distribution efficiencies, ensure the highest levels of service for our customers,

and improve working capital through the reduction of pharmacy inventory.

Our operating results are described in more detail in the ‘‘Results of Operations’’ section below.

Some of the key factors that impacted our results are summarized as follows:

Sales Trends: Our revenue growth for fiscal 2015 was 3.9% compared to revenue growth of 0.5%

for fiscal 2014. Fiscal 2015 revenues were positively impacted by an increase in same store sales and

same store prescription count, partially offset by a negative impact from generic introductions, lower

reimbursement rates, and store closings.

Gross Profit: Our gross profit was positively impacted by the increase in both pharmacy and front

end revenues, the continued impact of generic drugs, which have a higher gross profit than their brand

counterparts, purchasing efficiencies realized through our Purchasing and Delivery Arrangement, and a

LIFO credit of $18.9 million versus a LIFO charge of $104.1 million in fiscal 2014. The positive impacts

were somewhat offset by continued pharmacy reimbursement rate pressures. The current year LIFO

credit was due to higher generic deflation and pharmacy inventory reductions in connection with our

Purchasing and Delivery Arrangement.

Selling, General and Administrative Expenses: Our selling, general and administrative expenses

(‘‘SG&A’’) decreased as a percentage of revenues in fiscal 2015 as a result of leveraging the increase in

revenues and through various cost control initiatives. The increase on a dollar basis in fiscal 2015 is due

primarily to higher salary and payroll related expenses to support our increased sales volume and

operating costs of Health Dialog and RediClinic.

Lease Termination and Impairment Charges: We recorded lease terminations and impairment

charges of $41.9 million in fiscal 2015 compared to $41.3 million in fiscal 2014. Our charges have

remained consistent with the prior year due to similar financial results and store closure activity.

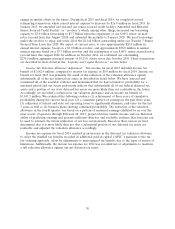

Debt Refinancing and Other Capital Transactions: During fiscal 2015, we continued to take steps to

extend the terms of our debt, reduce interest expense and to obtain more flexibility. We expect to

29