Rite Aid 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

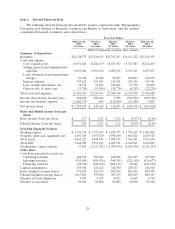

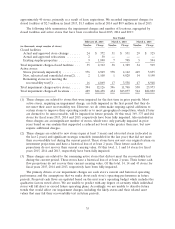

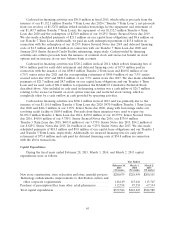

approximately 40 stores, primarily as a result of lease expirations. We recorded impairment charges for

closed facilities of $2.3 million in fiscal 2015, $1.3 million in fiscal 2014 and $0.9 million in fiscal 2013.

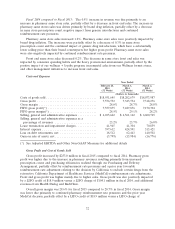

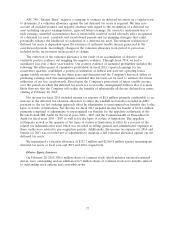

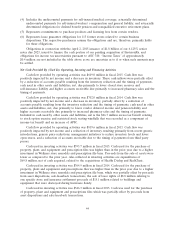

The following table summarizes the impairment charges and number of locations, segregated by

closed facilities and active stores that have been recorded in fiscal 2015, 2014 and 2013:

Year Ended

February 28, 2015 March 1, 2014 March 2, 2013

Number Charge Number Charge Number Charge

(in thousands, except number of stores)

Closed facilities:

Actual and approved store closings ...... 24 $ 372 31 $ 531 29 $ 325

Actual and approved relocations ........ 2 50 — — — —

Existing surplus properties ............ 9 1,890 7 798 5 594

Total impairment charges-closed facilities . . . 35 2,312 38 1,329 34 919

Active stores:

Stores previously impaired(1) .......... 376 6,949 378 4,162 469 5,835

New, relocated and remodeled stores(2) . . . 2 1,108 1 4,028 14 9,190

Remaining stores not meeting the

recoverability test(3) ............... 16 4,069 17 3,558 47 8,948

Total impairment charges-active stores ...... 394 12,126 396 11,748 530 23,973

Total impairment charges-all locations ...... 429 $14,438 434 $13,077 564 $24,892

(1) These charges are related to stores that were impaired for the first time in prior periods. Most

active stores, requiring an impairment charge, are fully impaired in the first period that they do

not meet their asset recoverability test. However, we do often make ongoing capital additions to

certain stores to improve their operating results or to meet geographical competition, which if later

are deemed to be unrecoverable, will be impaired in future periods. Of this total, 369, 375 and 464

stores for fiscal years 2015, 2014 and 2013, respectively have been fully impaired. Also included in

these charges are an insignificant number of stores, which were only partially impaired in prior

years based on our analysis that supported a reduced net book value greater than zero, but now

require additional charges.

(2) These charges are related to new stores (open at least 3 years) and relocated stores (relocated in

the last 2 years) and significant strategic remodels (remodeled in the last year) that did not meet

their recoverability test during the current period. These stores have not met our original return on

investment projections and have a historical loss of at least 2 years. Their future cash flow

projections do not recover their current carrying value. Of this total, 1, 1 and 14 stores for fiscal

years 2015, 2014 and 2013, respectively have been fully impaired.

(3) These charges are related to the remaining active stores that did not meet the recoverability test

during the current period. These stores have a historical loss of at least 2 years. Their future cash

flow projections do not recover their current carrying value. Of this total, 14, 14 and 43 stores for

fiscal years 2015, 2014 and 2013, respectively have been fully impaired.

The primary drivers of our impairment charges are each store’s current and historical operating

performance and the assumptions that we make about each store’s operating performance in future

periods. Projected cash flows are updated based on the next year’s operating budget which includes the

qualitative factors noted above. We are unable to predict with any degree of certainty which individual

stores will fall short or exceed future operating plans. Accordingly, we are unable to describe future

trends that would affect our impairment charges, including the likely stores and their related asset

values that may fail their recoverability test in future periods.

35