Rite Aid 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 28, 2015, March 1, 2014 and March 2, 2013

(In thousands, except per share amounts)

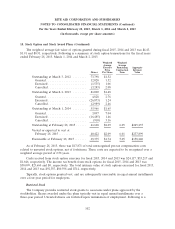

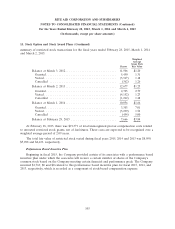

15. Stock Option and Stock Award Plans (Continued)

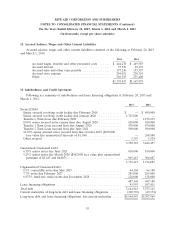

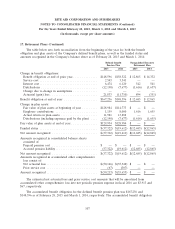

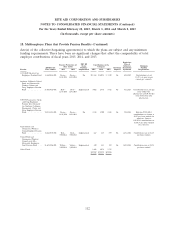

summary of restricted stock transactions for the fiscal years ended February 28, 2015, March 1, 2014

and March 2, 2013:

Weighted

Average

Grant Date

Shares Fair Value

Balance at March 3, 2012 ............................. 11,506 $1.20

Granted ........................................ 5,450 1.31

Vested ......................................... (3,917) 1.18

Cancelled ...................................... (362) 1.26

Balance at March 2, 2013 ............................. 12,677 $1.25

Granted ........................................ 2,743 2.79

Vested ......................................... (4,152) 1.23

Cancelled ...................................... (1,212) 1.48

Balance at March 1, 2014 ............................. 10,056 $1.66

Granted ........................................ 3,303 7.01

Vested ......................................... (5,239) 1.54

Cancelled ...................................... (454) 5.00

Balance at February 28, 2015 .......................... 7,666 $3.84

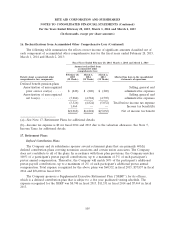

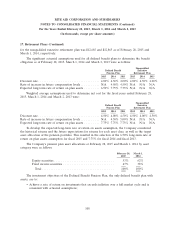

At February 28, 2015, there was $19,371 of total unrecognized pre-tax compensation costs related

to unvested restricted stock grants, net of forfeitures. These costs are expected to be recognized over a

weighted average period of 2.09 years.

The total fair value of restricted stock vested during fiscal years 2015, 2014 and 2013 was $8,090,

$5,098 and $4,623, respectively.

Performance Based Incentive Plan

Beginning in fiscal 2015, the Company provided certain of its associates with a performance based

incentive plan under which the associates will receive a certain number of shares of the Company’s

common stock based on the Company meeting certain financial and performance goals. The Company

incurred $1,769, $0 and $0 related to this performance based incentive plan for fiscal 2015, 2014, and

2013, respectively, which is recorded as a component of stock-based compensation expense.

103