Rite Aid 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

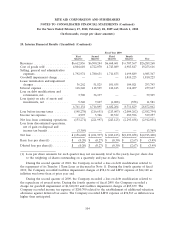

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2010, February 28, 2009 and March 1, 2008

(In thousands, except per share amounts)

16. Retirement Plans (Continued)

• Balance the correlation between assets and liabilities by diversifying the portfolio among various

asset classes to address return risk and interest rate risk;

• Balance the allocation of assets between the investment managers to minimize concentration

risk;

• Maintain liquidity in the portfolio sufficient to meet plan obligations as they come due; and

• Control administrative and management costs.

The asset allocation established for the pension investment program reflects the risk tolerance of

the Company, as determined by:

• The current and anticipated financial strength of the Company;

• the funded status of the plan; and

• plan liabilities.

Investments in both the equity and fixed income markets will be maintained, recognizing that

historical results indicate that equities (primarily common stocks) have higher expected returns than

fixed income investments. It is also recognized that the correlation between assets and liabilities must

be balanced to address higher volatility of equity investments (return risk) and interest rate risk.

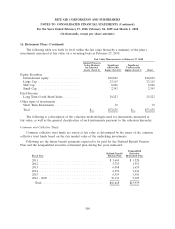

The following targets are to be applied to the allocation of plan assets.

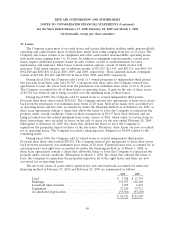

Category Target Allocation

U.S. equities ................................... 45%

International equities ............................ 15%

U.S. fixed income ............................... 40%

Total ....................................... 100%

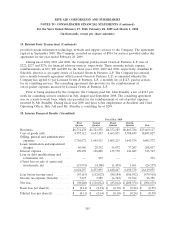

The Company expects to contribute $1,520 to the nonqualified executive retirement plan during

fiscal 2011. Included in prepaid expenses and other current assets is a prepayment of the fiscal 2011

Deferred Benefit Plan contribution of $13,451.

99