Rite Aid 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$2.31 billion in cash and issued 250 million shares of Rite Aid common stock. We financed our cash

payment via the establishment of a new term loan facility, issuance of senior notes and borrowings

under our existing revolving credit facility. As part of the arrangement of the financing necessary to

complete the acquisition, we incurred a $12.9 million fee for bridge financing that ultimately was not

needed. This fee was recorded as a loss on debt modification in our statement of operations for fiscal

2008.

As of February 27, 2010, Jean Coutu Group owned 252.0 million shares of Rite Aid common

stock, which represents approximately 27.5% of the total Rite Aid voting power. We expanded our

Board of Directors to 14 members, with four of the seats being held by members designated by the

Jean Coutu Group. In connection with the Acquisition, we entered into a Stockholder Agreement (the

‘‘Stockholder Agreement’’) with Jean Coutu Group and certain family members. The Stockholder

Agreement contains provisions relating to Jean Coutu Group’s ownership interest in the Company,

board and board committee composition, corporate governance, stock ownership, stock purchase rights,

transfer restrictions, voting arrangements and other matters. We also entered into a registration rights

agreement with Jean Coutu Group giving Jean Coutu Group certain rights with respect to the

registration under the Securities Act of 1933, as amended, of the shares of our common stock issued to

Jean Coutu Group or acquired by Jean Coutu Group pursuant to certain stock purchase rights or open

market rights under the Stockholder Agreement.

Debt Refinancing. In fiscal years 2010 and 2009, we took several steps to extend the terms of our

debt and obtain more flexibility. In fiscal 2010, we refinanced our first and second lien securitization

facilities. The refinancing consisted of the issuance of $270.0 million of new 10.25% Senior Secured

Notes due October 2019, commitments to increase the maximum borrowing capacity under our existing

senior secured revolving credit facility from $1.0 billion to $1.175 billion, and an increase in the

borrowings under our existing $525.0 million Tranche 4 term loan due June 2015 by $125.0 million to

$650.0 million. Additionally, we issued $410.0 million of 9.75% senior secured notes due June 2016

proceeds of which repaid all borrowings outstanding under the revolving credit facility due September

2010 and all of the commitments thereunder. We also repaid all borrowings due under the

$145.0 million Tranche 1 Term Loan. We incurred fees of $60.2 million to consummate the fiscal 2010

refinancings. In fiscal 2009, we issued our 8.5% convertible notes due May 2015, the proceeds of which

were used to redeem our 6.125% notes due December 2008. Additionally, we consummated a tender

offer and consent solicitation and repaid $348.9 million of our 8.125% notes due May 2010,

$144.0 million of our 9.25% notes due June 2013 and the full balance of our 7.5% notes due January

2015. Proceeds from the issuance of our 10.375% notes due July 2016 and our Tranche 3 term loan

were used to fund the tender offer and consent solicitation. We incurred charges of $39.9 million to call

these notes prior to maturity and write-off unamortized debt issue costs.

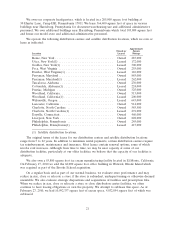

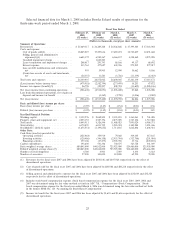

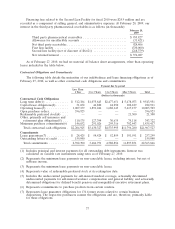

Dilutive Equity Issuances. At February 27, 2010, 887.6 million shares of common stock were

outstanding and an additional 164.9 million shares of common stock were issuable related to

outstanding stock options, convertible preferred stock and convertible notes.

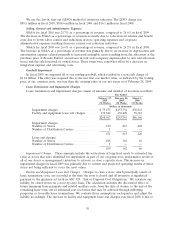

Our 164.9 million shares of potentially issuable common stock consist of the following (shares in

thousands):

Outstanding Preferred Convertible

Strike price Stock Options(a) Stock Notes Total

$0.99 and under .............................. 14,173 — — 14,173

$1.00 to $1.99 ................................ 16,744 — — 16,744

$2.00 to $2.99 ................................ 8,895 — 61,045 69,940

$3.00 to $3.99 ................................ 1,685 — — 1,685

$4.00 to $4.99 ................................ 21,131 — — 21,131

$5.00 to $5.99 ................................ 3,816 27,692 — 31,508

$6.00 and over ............................... 9,670 — — 9,670

Total issuable shares ........................... 76,114 27,692 61,045 164,851

(a) The exercise of these options would provide cash of $234.3 million.

27