Rite Aid 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2010, February 28, 2009 and March 1, 2008

(In thousands, except per share amounts)

19. Related Party Transactions (Continued)

provided certain information technology, network and support services to the Company. The agreement

expired in September 2008. The Company recorded an expense of $894 for services provided under this

agreement for the year ended February 28, 2009.

During fiscal 2010, 2009 and 2008, the Company paid Leonard Green & Partners, L.P., fees of

$222, $227 and $276, for financial advisory services, respectively. These amounts include expense

reimbursements of $72, $90 and $89 for the fiscal years 2010, 2009 and 2008, respectively. Jonathan D.

Sokoloff, director, is an equity owner of Leonard Green & Partners, L.P. The Company has entered

into a month-to-month agreement with Leonard Green & Partners, L.P., as amended whereby the

Company has agreed to pay Leonard Green & Partners, L.P., a monthly fee of $12.5, paid in arrears,

for its consulting services. The consulting agreement also provides for the reimbursement of

out-of-pocket expenses incurred by Leonard Green & Partners, L.P.

Prior to being employed by the Company, the Company paid Mr. John Standley a fee of $32.5 per

week for consulting services rendered in July, August and September 2008. The consulting agreement

was on a week-to-week basis, which also provided for the reimbursement of out-of-pocket expenses

incurred by Mr. Standley. During fiscal year 2009 and prior to his employment as President and Chief

Operating Officer, Rite Aid paid Mr. Standley a consulting fee of $294.

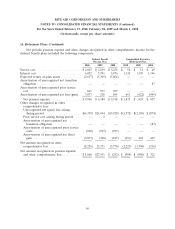

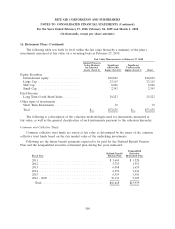

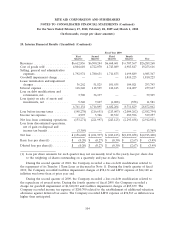

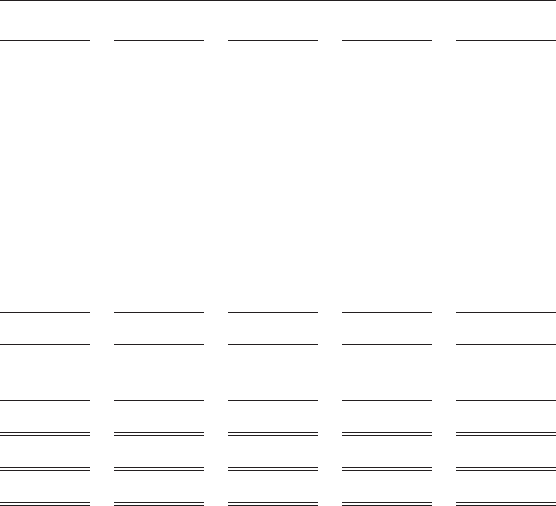

20. Interim Financial Results (Unaudited)

Fiscal Year 2010

First Second Third Fourth

Quarter Quarter Quarter Quarter Year

Revenues ..................... $6,531,178 $6,321,870 $6,352,283 $6,463,786 $25,669,117

Cost of goods sold .............. 4,757,112 4,633,595 4,665,871 4,788,449 18,845,027

Selling, general and administrative

expenses ................... 1,710,672 1,645,913 1,605,213 1,641,574 6,603,372

Lease termination and impairment

charges .................... 66,986 28,752 35,072 77,207 208,017

Interest expense ................ 109,478 128,828 135,770 141,687 515,763

Loss on debt modifications and

retirements, net .............. — 993——993

(Gain) loss on sale of assets and

investments, net .............. (19,951) (4,188) (1,459) 1,461 (24,137)

6,624,297 6,433,893 6,440,467 6,650,378 26,149,035

Loss before income taxes ......... (93,119) (112,023) (88,184) (186,592) (479,918)

Income tax expense (benefit) ...... 5,327 3,989 (4,322) 21,764 26,758

Net loss ...................... $ (98,446) $ (116,012) $ (83,862) $ (208,356) $ (506,676)

Basic loss per share(1) ........... $ (0.11) $ (0.14) $ (0.10) $ (0.24) $ (0.59)

Diluted loss per share(1) ......... $ (0.11) $ (0.14) $ (0.10) $ (0.24) $ (0.59)

103