Rite Aid 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2010, February 28, 2009 and March 1, 2008

(In thousands, except per share amounts)

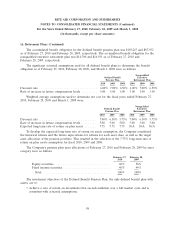

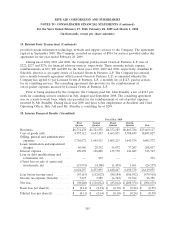

16. Retirement Plans (Continued)

The accumulated benefit obligation for the defined benefit pension plan was $103,247 and $87,932

as of February 27, 2010 and February 28, 2009, respectively. The accumulated benefit obligation for the

nonqualified executive retirement plan was $14,780 and $16,931 as of February 27, 2010 and

February 28, 2009, respectively.

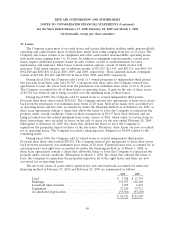

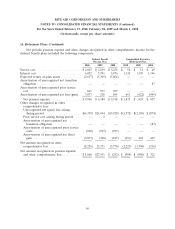

The significant actuarial assumptions used for all defined benefit plans to determine the benefit

obligation as of February 27, 2010, February 28, 2009, and March 1, 2008 were as follows:

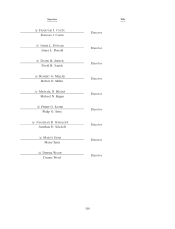

Nonqualified

Defined Benefit Executive

Pension Plan Retirement Plan

2010 2009 2008 2010 2009 2008

Discount rate ................................. 6.00% 7.00% 6.50% 6.00% 7.00% 6.50%

Rate of increase in future compensation levels ......... 5.00 5.00 5.00 3.00 3.00 3.00

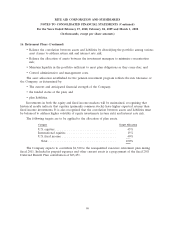

Weighted average assumptions used to determine net cost for the fiscal years ended February 27,

2010, February 28, 2009 and March 1, 2008 were:

Nonqualified

Defined Benefit Executive

Pension Plan Retirement Plan

2010 2009 2008 2010 2009 2008

Discount rate ................................. 7.00% 6.50% 5.75% 7.00% 6.50% 5.75%

Rate of increase in future compensation levels ......... 5.00 5.00 5.00 3.00 3.00 3.00

Expected long-term rate of return on plan assets ....... 7.75 7.75 7.75 N/A N/A N/A

To develop the expected long-term rate of return on assets assumption, the Company considered

the historical returns and the future expectations for returns for each asset class, as well as the target

asset allocation of the pension portfolio. This resulted in the selection of the 7.75% long-term rate of

return on plan assets assumption for fiscal 2010, 2009 and 2008.

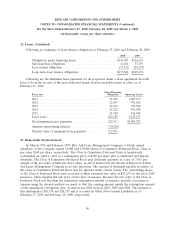

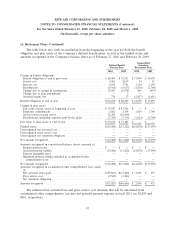

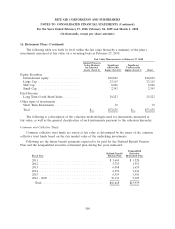

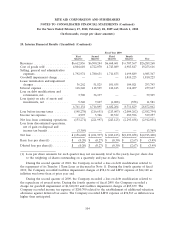

The Company’s pension plan asset allocations at February 27, 2010 and February 28, 2009 by asset

category were as follows:

February 27, February 28,

2010 2009

Equity securities ................................ 60% 56%

Fixed income securities ........................... 40% 44%

Total ...................................... 100% 100%

The investment objectives of the Defined Benefit Pension Plan, the only defined benefit plan with

assets, are to:

• Achieve a rate of return on investments that exceeds inflation over a full market cycle and is

consistent with actuarial assumptions;

98