Rite Aid 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2010, February 28, 2009 and March 1, 2008

(In thousands, except per share amounts)

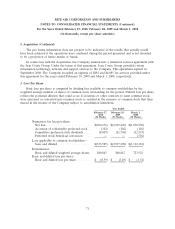

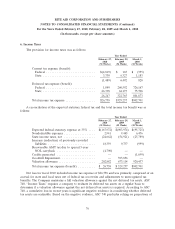

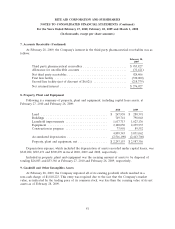

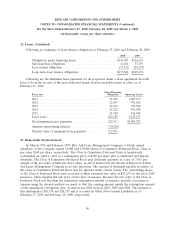

7. Accounts Receivable (Continued)

At February 28, 2009, the Company’s interest in the third party pharmaceutical receivables was as

follows:

February 28,

2009

Third party pharmaceutical receivables ......................... $955,827

Allowance for uncollectible accounts .......................... (31,421)

Net third party receivables .................................. 924,406

First lien facility ......................................... (330,000)

Second lien facility (net of discount of $6,621) ................... (218,379)

Net retained interest ...................................... $376,027

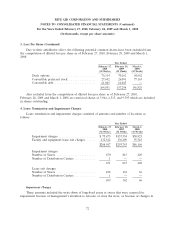

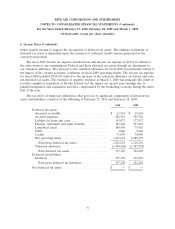

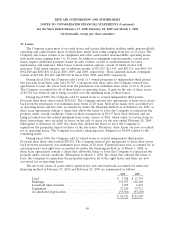

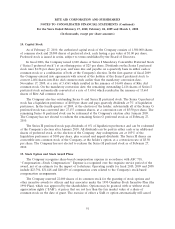

8. Property, Plant and Equipment

Following is a summary of property, plant and equipment, including capital lease assets, at

February 27, 2010 and February 28, 2009:

2010 2009

Land ...................................... $ 267,938 $ 280,391

Buildings ................................... 749,741 798,048

Leasehold improvements ........................ 1,617,713 1,623,136

Equipment .................................. 2,100,050 2,239,935

Construction in progress ........................ 73,901 89,552

4,809,343 5,031,062

Accumulated depreciation ....................... (2,516,190) (2,443,706)

Property, plant and equipment, net ................. $2,293,153 $ 2,587,356

Depreciation expense, which included the depreciation of assets recorded under capital leases, was

$349,282, $383,671 and $309,270 in fiscal 2010, 2009 and 2008, respectively.

Included in property, plant and equipment was the carrying amount of assets to be disposed of

totaling $26,003 and $33,386 at February 27, 2010 and February 28, 2009, respectively.

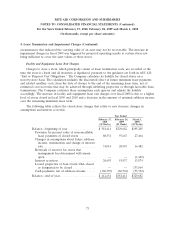

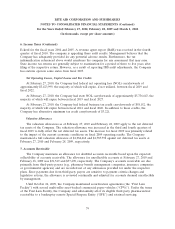

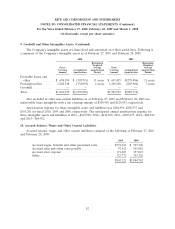

9. Goodwill and Other Intangibles Assets

At February 28, 2009, the Company impaired all of its existing goodwill, which resulted in a

non-cash charge of $1,810,223. This entry was required due to the fact that the Company’s market

value, as indicated by the trading price of its common stock, was less than the carrying value of its net

assets as of February 28, 2009.

81