Rite Aid 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2010, February 28, 2009 and March 1, 2008

(In thousands, except per share amounts)

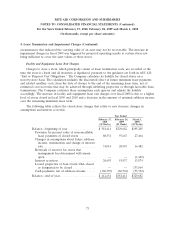

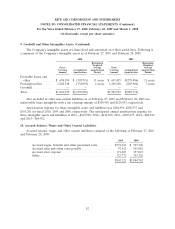

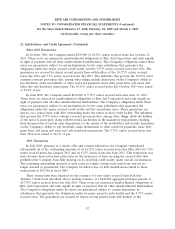

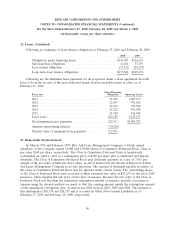

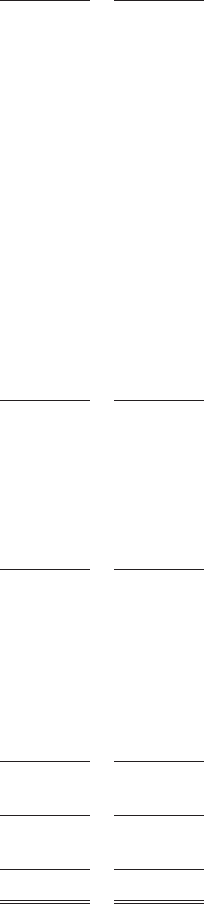

11. Indebtedness and Credit Agreement

Following is a summary of indebtedness and lease financing obligations at February 27, 2010 and

February 28, 2009:

2010 2009

Secured Debt:

Senior secured revolving credit facility due September 2010 ............ $ — $ 838,000

Senior secured credit facility term loan due September 2010 ........... — 145,000

Senior secured revolving credit facility due September 2012 ............ 80,000 —

Senior secured credit facility term loan due June 2014 ................ 1,085,663 1,096,713

Senior secured credit facility term loan due June 2014 ($345,625 and

$349,125 face value less unamortized discount of $25,634 and $31,549) . . 319,991 317,576

Senior secured credit facility term loan due June 2015 ($650,000 face value

less unamortized net discount of $15,036) ....................... 634,964 —

9.75% senior secured notes (first lien) due June 2016 ($410,000 face value

less unamortized discount of $6,692) ........................... 403,308 —

10.375% senior secured notes (second lien) due July 2016 ($470,000 face

value less unamortized discount of $35,481 and $41,011) ............ 434,519 428,989

7.5% senior secured notes (second lien) due March 2017 .............. 500,000 500,000

10.25% senior secured notes (second lien) due October 2019 ($270,000

face value less unamortized discount of $1,978) ................... 268,022 —

Other secured ............................................. 2,316 4,194

3,728,783 3,330,472

Guaranteed Unsecured Debt:

8.625% senior notes due March 2015 ............................ 500,000 500,000

9.375% senior notes due December 2015 ($410,000 face value less

unamortized discount of $4,049 and $4,754) ...................... 405,951 405,246

9.5% senior notes due June 2017 ($810,000 face value less unamortized

discount of $9,431 and $10,732) .............................. 800,569 799,268

1,706,520 1,704,514

Unsecured Unguaranteed Debt:

8.125% notes due May 2010 ................................... 11,117 11,117

9.25% senior notes due June 2013 .............................. 6,015 6,015

6.875% senior debentures due August 2013 ........................ 184,773 184,773

8.5% convertible notes due May 2015 ............................ 158,000 158,000

7.7% notes due February 2027 ................................. 295,000 295,000

6.875% fixed-rate senior notes due December 2028 .................. 128,000 128,000

782,905 782,905

Lease financing obligations ..................................... 152,691 193,818

Total debt ................................................. 6,370,899 6,011,709

Current maturities of long-term debt and lease financing obligations ....... (51,502) (40,683)

Long-term debt and lease financing obligations, less current maturities ..... $6,319,397 $5,971,026

83