Rite Aid 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We will not be able to compete effectively if we are unable to attract, hire and retain qualified pharmacists.

The national shortage of pharmacists has eased over the past 12 months, resulting in more licensed

pharmacists and new graduates seeking positions in many markets. Although this is occurring

nationally, there is still an unmet demand for pharmacists in certain regions of the country that are

challenging to staff. We continue to offer competitive compensation plans to retain and attract current

and future pharmacists, work with Colleges of Pharmacy across the U.S. to recruit both pharmacy

interns and pharmacy graduates and conduct a recruiting program for international pharmacists, but if

the shortage recurs in one or more markets, our ability to compete effectively in that market could be

adversely impacted.

We may be subject to significant liability should the consumption of any of our products cause injury, illness

or death.

Products that we sell could become subject to contamination, product tampering, mislabeling or

other damage requiring us to recall our private brand products. In addition, errors in the dispensing

and packaging of pharmaceuticals could lead to serious injury or death. Product liability claims may be

asserted against us with respect to any of the products or pharmaceuticals we sell and we may be

obligated to recall our private brand products. A product liability judgment against us or a product

recall could have a material, adverse effect on our business, financial condition or results of operations.

If we fail to protect the security of personal information about our customers and associates, we could be

subject to costly government enforcement actions or private litigation.

Through our sales and marketing activities, we collect and store certain personal information that

our customers provide to purchase products or services, enroll in promotional programs, register on our

web site, or otherwise communicate and interact with us. We also gather and retain information about

our associates in the normal course of business. We may share information about such persons with

vendors that assist with certain aspects of our business. Despite instituted safeguards for the protection

of such information, security could be compromised and confidential customer or business information

misappropriated. Loss of customer or business information could disrupt our operations, damage our

reputation, and expose us to claims from customers, financial institutions, payment card associations

and other persons, any of which could have an adverse effect on our business, financial condition and

results of operations. In addition, compliance with tougher privacy and information security laws and

standards may result in significant expense due to increased investment in technology and the

development of new operational processes.

Item 1B. Unresolved SEC Staff Comments

None

Item 2. Properties

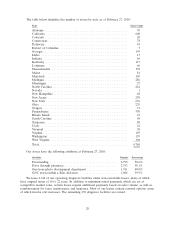

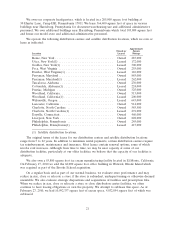

As of February 27, 2010, we operated 4,780 retail drugstores. The overall average selling square

feet of each store in our chain is 10,000 square feet. The overall average total square feet of each store

in our chain is 12,500. The stores in the eastern part of the U.S. average 8,800 selling square feet per

store (10,900 average total square feet per store). The stores in the western part of the U.S. average

15,400 selling square feet per store (19,800 average total square feet per store).

Our Customer World store prototype has an overall average selling square footage of 11,500 and

an overall average total square feet of 14,500. The new Customer World store prototype in the eastern

parts of the U.S. averages 11,000 selling square feet (14,000 average total square feet per store). The

Customer World store prototype in the western part of the U.S. averages 14,000 selling square feet

(17,400 average total square feet per store).

19