Rite Aid 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We use the last-in, first-out (LIFO) method of inventory valuation. The LIFO charge was

$88.5 million in fiscal 2010, $184.6 million in fiscal 2009 and $16.1 million in fiscal 2008.

Selling, General and Administrative Expenses

SG&A for fiscal 2010 was 25.7% as a percentage of revenue, compared to 26.6% in fiscal 2009.

The decrease in SG&A as a percentage of revenues is mostly due to a decrease in salaries and benefit

costs due to better labor control and reductions in store operating expenses and corporate

administrative expenses resulting from our various cost reduction initiatives.

SG&A for fiscal 2009 was 26.6% as a percentage of revenue, compared to 26.2% in fiscal 2008.

The increase in SG&A as a percentage of revenue was primarily due to an increase in depreciation and

amortization expense related primarily to increased intangible assets resulting from the allocation of the

purchase price of Brooks Eckerd, an increase in rent and occupancy expenses due to new and relocated

stores and the sale-leaseback of owned stores. These items were somewhat offset by a decrease in

integration expense and advertising costs.

Goodwill Impairment

In fiscal 2009, we impaired all of our existing goodwill, which resulted in a non-cash charge of

$1.81 billion. This entry was required due to the fact that our market value, as indicated by the trading

price of our common stock, was less than the carrying value of our net assets as of February 28, 2009.

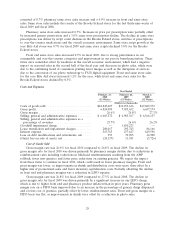

Lease Termination and Impairment Charges

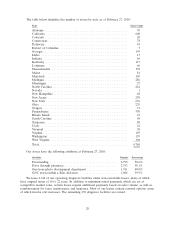

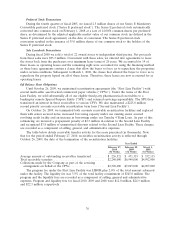

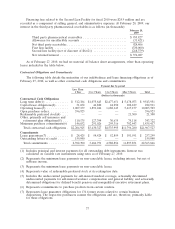

Lease termination and impairment charges consist of amounts and number of locations as follows:

Year Ended

February 27, February 28, March 1,

2010 2009 2008

(52 Weeks) (52 Weeks) (52 Weeks)

(Dollars in thousands)

Impairment charges ..................... $ 75,475 $157,334 $30,823

Facility and equipment lease exit charges ..... 132,542 136,409 55,343

$208,017 $293,743 $86,166

Impairment charges

Number of Stores ...................... 670 815 420

Number of Distribution Centers ............ 1 — —

671 815 420

Lease exit charges

Number of Stores ...................... 108 162 66

Number of Distribution Centers ............ 1 — —

109 162 66

Impairment Charges. These amounts include the write-down of long-lived assets to estimated fair

value at stores that were identified for impairment as part of our on-going store performance review at

all of our stores or management’s intention to relocate or close a specific store. The increase in

impairment charges in fiscal 2009 was primarily due to current and projected operating results at these

stores not being sufficient to cover the asset values.

Facility and Equipment Lease Exit Charges. Charges to close a store, which principally consist of

lease termination costs, are recorded at the time the store is closed and all inventory is liquidated,

pursuant to the guidance set forth in ASC 420, ‘‘Exit or Disposal Cost Obligations.’’ We calculate our

liability for closed stores on a store-by-store basis. The calculation includes the discounted effect of

future minimum lease payments and related ancillary costs, from the date of closure to the end of the

remaining lease term, net of estimated cost recoveries that may be achieved through subletting

properties or favorable lease terminations. We evaluate these assumptions each quarter and adjust the

liability accordingly. The increase in facility and equipment lease exit charges over fiscal 2008 is due to

30