Porsche 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

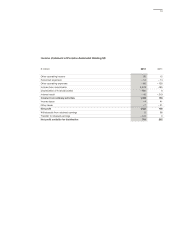

Financial position

The cash flow from operating activities of the

Porsche SE group came to 202 million euro in the

2012 fiscal year (prior year: 43 million euro). This

contains the positive effect from dividends

received from Volkswagen AG of 330 million euro

(prior year: 243 million euro) and from Porsche

Holding Stuttgart GmbH of 104 million euro (prior

year: 128 million euro). A further cash outflow of

149 million euro resulted from the settlement in

August 2012 of a liability due to Qatar Holding

LLC. Interest paid in the fiscal year 2012 came to

141 million euro (prior year: 366 million euro);

interest received came to 114 million euro (fiscal

year 2011: 191 million euro). In addition, there was

an inflow from income tax refunds of 1 million

euro in the fiscal year 2012 (prior year: 176 million

euro). On the other hand, there was a cash out-

flow from income taxes paid of 2 million euro

(prior year: 278 million euro).

There was a cash inflow from investment ac-

tivities totaling 2,627 million euro in the fiscal year

2012 (prior year: 115 million euro). In the fiscal

year 2012, this mainly includes the payment re-

ceived from Volkswagen AG in return for the con-

tribution of the holding business operations less

the cash and cash equivalents disposed of in

connection with the contribution of the business

operations. The investment of cash and cash

equivalents in time deposits with an original term

of more than three months had a counter effect.

There was a cash outflow from financing

activities of 2,295 million euro (prior year: 196

million euro) in the fiscal year 2012. In the fiscal

year 2012, this is essentially attributable to the full

repayment of the liabilities to banks of 2.0 billion

euro (prior year: 7.0 billion euro), which was made

using part of the consideration received from

Volkswagen AG in return for the contribution of

the holding business operations. Moreover, cash

outflows result from the dividend distribution to

the shareholders of Porsche SE of 232 million

euro (prior year: 77 million euro) and payments

to the hybrid capital investors of 11 million euro

(prior year: 22 million euro). In addition, there was

a cash outflow of 52 million euro from the repur-

chase of hybrid capital in the fiscal year 2012. The

cash flow from financing activities in the fiscal

year 2011 contained in particular the gross issue

proceeds of 4,988 million euro from the capital

increase in April 2011, less all related transaction

costs of 85 million euro incurred in 2011.

Compared with 31 December 2011, cash

funds increased by 534 million euro to 902 million

euro.

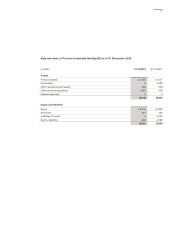

Gross liquidity, i.e., cash and cash equivalents

and time deposits of the Porsche SE group, in-

creased from 469 million euro in the prior year to

2,862 million euro as of 31 December 2012. Liabili-

ties to banks were repaid in full. As of 31 Decem-

ber 2011, liabilities to banks still amounted to

1,991 million euro. Taking into account the loan

liabilities of 300 million euro due to the

Volkswagen group net liquidity – i.e., cash and

cash equivalents and time deposits less loan liabil-

ities (prior year: liabilities to banks) – is clearly

positive at 2,562 million euro as of 31 December

2012. As of 31 December 2011, the corresponding

figure had still been minus 1,522 million euro.

Net assets

Compared with 31 December 2011, Porsche SE’s

total assets decreased by 1,754 million euro from

32,965 million euro to 31,211 million euro as of

31 December 2012, mainly as a result of the con-

tribution of the holding business operations of

Porsche SE to Volkswagen AG, and the full re-

payment of the liabilities to banks.

As of 31 December 2012, the non-current as-

sets of the Porsche SE group essentially comprise

the investment accounted for at equity in

Volkswagen AG of 27,517 million euro (31 Decem-

ber 2011: 24,272 million euro). The increase in the

carrying amount of this investment of 3,245 million

euro is primarily attributable to the profit of the

Volkswagen group. The investment in Porsche

2The company

Group management report

250