Porsche 2012 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2012 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

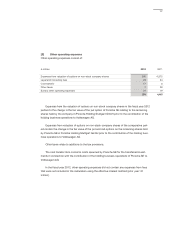

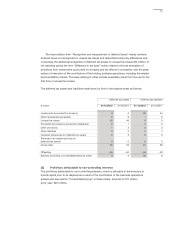

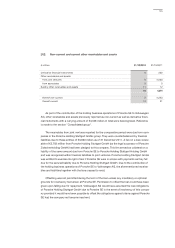

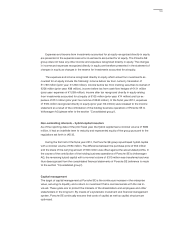

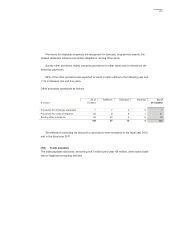

The options on non-stock company shares contained the positive fair value of the put option

on the remaining shares held by Porsche SE in Porsche Holding Stuttgart GmbH prior to the

contribution of the holding business operations to Volkswagen AG.

Further details on derivative financial instruments are given in note [21].

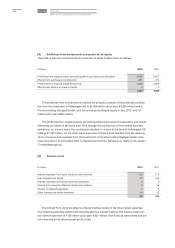

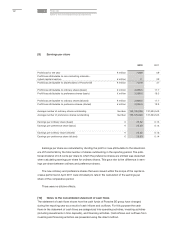

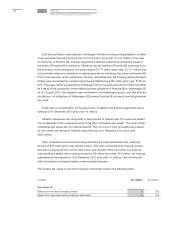

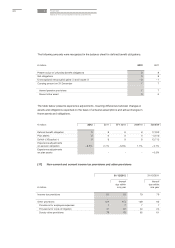

[13] Income tax assets

The income tax assets are mainly reimbursement claims for tax on investment income (including

solidarity surcharge) which relate to profit distributions or dividends. The line item contains the

tax on investment income (including solidarity surcharge) triggered by the decision to pay out an

advance profit distribution from Porsche Holding Stuttgart GmbH prior to the contribution of the

holding business operations of Porsche SE to Volkswagen AG. The related claims of Porsche SE

to future refunds were assigned to an associate. Reference is made to the section "Consolidated

group" and note [20].

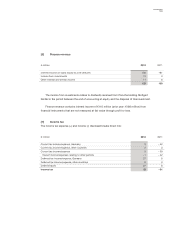

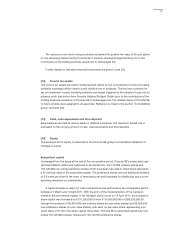

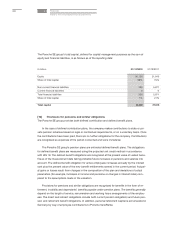

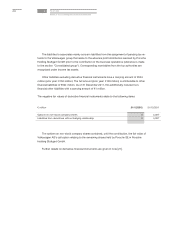

[14] Cash, cash equivalents and time deposits

Bank balances are held at various banks in different currencies. The maximum default risk is

equivalent to the carrying amount of cash, cash equivalents and time deposits.

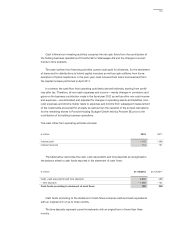

[15] Equity

The development of equity is presented in the Porsche SE group’s consolidated statement of

changes in equity.

Subscribed capital

Unchanged from the figure at the end of the comparative period, Porsche SE’s subscribed capi-

tal totals €306.25 million and continues to be divided into 153,125,000 ordinary shares and

153,125,000 non-voting preference shares which have been fully paid in. Each share represents

a €1 notional value of the subscribed capital. The preference shares carry an additional dividend

of 0.6 cents per share in the event of there being net profit available for distribution and a corre-

sponding resolution on a distribution.

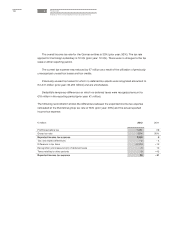

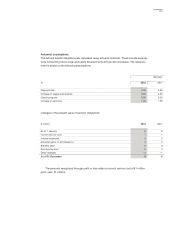

A capital increase in return for cash contributions was performed in the comparative period

between 27 March and 13 April 2011. With the entry of the implementation of the capital in-

crease in the commercial register of the Stuttgart district court on 13 April 2011, the company’s

share capital was increased by €131,250,000.00 from €175,000,000.00 to €306,250,000.00

through the issuance of 65,625,000 new ordinary shares (no-par-value shares) and 65,625,000

new preference shares (no-par-value shares), with each no-par-value share representing a no-

tional share of €1.00 in the share capital. Since then, Porsche SE’s subscribed capital has com-

prised 153,125,000 ordinary shares and 153,125,000 preference shares.

197