Porsche 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

members of the Porsche and Piëch families, a circumstance that in

the past fiscal year again provided the necessary basis for the

company’s operative activities. More than half of the preference

shares are held by institutional investors such as investment funds,

banks and insurance companies. These are mainly based in Great

Britain, the USA and Germany, but to a lesser extent also in other

European countries and Asia. Slightly less than half of the Porsche

preference stock is widely distributed among private investors,

primarily in Germany. Holders of Porsche AG’s common stock also

hold preference stock.

Clear Positions on Stock Market Topics

On the capital market as elsewhere, Porsche demonstrates courage

and determination and is prepared to stand up for its own opinions.

In the review year as before, the company spoke out vehemently

against the call for it to submit quarterly reports and has not hesitated

to defend its views on this subject in the courts of law. Porsche has for

example submitted a voidance petition to the Administrative Court of

the Federal German State of Hesse in Kassel with the intention of clar-

ifying the legality of the ruling that the submission of quarterly reports

is a precondition for admission to the German Stock Exchange’s Prime

Standard ranking. Porsche regards this ruling as invalid and therefore

took legal action at the Frankfurt Administrative Court in Frankfurt

prior to its submission in Kassel. The Frankfurt court was evidently

unwilling to resolve this key question, and for this reason Porsche

lost no time in submitting its application to the Hesse Administrative

Court in Kassel, the decision of which was still pending when this

report closed for publication.

Since it was first quoted on the stock exchange in 1984, Porsche has

never published quarterly reports. The German Stock Exchange there-

fore struck it off the M-Dax list and refused it Prime Standard ranking.

Porsche’s refusal to publish quarterly reports, however, is based on

fundamental considerations, since such reports increase the volatility

of the stock market unnecessarily and thus give rise to hectic stock

price fluctuations. In addition, they encourage short-term corporate

thinking, which would be particularly harmful to the sound long-term

development of a relatively small manufacturer such as Porsche.

Porsche does not intend to be forced into such a short-winded posi-

tion, but will maintain its policy of credible substance and continuous

information. The company’s refusal to publish quarterly reports has

had no adverse effects on the price of the stock. On the contrary, there

has been increasing interest on the part of investors in recent years,

especially at international level. This has been aided by the fact that

Porsche has for some time now been included in two highly reputable

international indices: the “Morgan Stanley Capital International” index

and the “Dow Jones STOXX 600”. Furthermore, the company has

been included from March 2005 on in the British “FTSE4Good” Index,

which comprises only share-issuing companies that pursue a corpo-

rate policy oriented toward ecological, ethical and social criteria.

The Stuttgart-based automobile manufacturer also adopted a firm

position with regard to another stock-market topic during the review

year: the fusion of the stock exchanges in Frankfurt and London,

planned for the beginning of 2005. Porsche has expressed its oppo-

sition to the take over plans of the Deutsche Börse AG since it feels

that the fusion would adversely affect the interests of German share-

issuing companies and lead to domination of the market. A number

of experts on the Frankfurt financial scene share this opinion, and like

Porsche were no doubt relieved to learn that pressure from its own

shareholders has now forced Deutsche Börse AG to abandon its

takeover plans.

Porsche also adopted a clear position on the question of forcing

companies listed on the stock exchange by law to publish the salaries

paid to members of their boards of management. This decision was

taken by the Federal German government in June 2005. In Porsche’s

opinion, publishing the sums earned by individual board members does

not provide any extra knowledge that could be relevant to investors’

purchase or selling decisions. On the contrary, when taking an invest-

ment decision the investor needs only to be in a position to decide

whether the total amount paid to the Executive Board is in reasonable

proportion to the company’s success. Porsche is firmly convinced

that it is sufficient as before to state the total sum earned by the

members of the Executive Board and the proportions thereof that

are fixed or success-related.

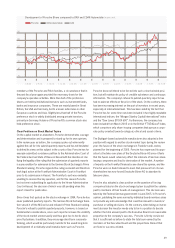

Development of Porsche Share compared to DAX and CDAX-Automobile in percent

130

120

110

100

90

80

70

1.8.04 1.9.04 1.10.04 1.11.04 1.12.04 1.1.05 1.2.05 1.3.05 1.4.05 1.5.05 1.6.05 1.7.05 31.7.05

Porsche CDAX-Automobile DAX