Porsche 2004 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

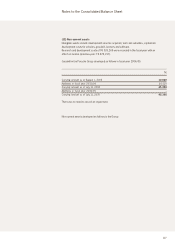

An impairment test is performed at least once a year for goodwill, but for other intangible assets

with finite useful lives as well as property, plant and equipment and leased assets only when there

is an indication that the asset may be impaired. An impairment loss is recognized if the recoverable

amount of the asset falls short of the carrying amount. The recoverable amount is generally de-

termined separately per individual asset. If this is not possible, it is determined on the basis of a

group of assets or the legal entity. The recoverable amount is the higher of an asset’s net selling

price and its value in use. The net selling price is the amount obtainable from the sale of an asset

at customary market conditions less the costs of disposal. Value in use is determined using the

discounted cash flow method on the basis of the estimated future cash flows expected to arise

from the continuing use and its disposal. The cash flows are derived from the long-term business

planning and current developments are taken into account. They are discounted to the balance

sheet date using discount rates for similar risks (before tax) of an average of ten percent.

If the reason for impairment losses recorded in previous years ceases to exist, the impairment loss

is reversed to a maximum amount of amortized cost. This does not apply for goodwill.

Current assets

Inventories

Inventories include materials and supplies as well as work in process and finished goods.

Inventories are stated at the lower of cost or net realizable value as of the balance sheet date.

Valuation allowances are recorded on slow-moving inventories.

In addition to direct costs, costs of conversion include an appropriate portion of necessary

materials and production overheads as well as production-related depreciation, administrative and

social security costs. Finance cost is not capitalized as part of cost of purchase or conversion.

Where necessary, the average method is used as a simplified method of measurement.

Long-term construction contracts

Future receivables from long-term construction contracts are recognized according to the per-

centage of completion method. The percentage of completion per contract to be recognized is

calculated by comparing the accumulated costs with the total costs expected (“cost-to-cost”

method). If the result of a construction contract cannot be determined reliably, income is only

recognized at the amount of the contract costs incurred (“zero profit method”). If the total of

accumulated contract costs and reported profits exceeds advance payments received, the con-

struction contracts are recognized as an asset as future receivables from long-term construction

contracts under trade receivables. Any negative balance is reported under trade payables.

The principle of valuing assets at net realizable value is observed.