Porsche 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

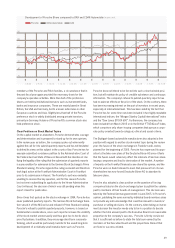

Porsche Stock Prices stimulated by the General Situation

Financial markets made a worldwide recovery in the review year,

though stock exchange indices failed to reach the high levels com-

monly encountered during the New Economy boom. Nevertheless,

prices developed in a positive manner, this being largely due to an

improved company earnings situation. After some years of falling

profits or even losses, the cost reduction programs initiated during

the crisis are now yielding results. In addition, the order situation in

the industrial sector has improved worldwide, and satisfactory new

business was recorded in the financial sector as well.

During the review year, the German Stock Market Index (Dax) remained

for lengthy periods at or around the 4,000-point mark. Regular signs

of upward potential took it close to 5,000 points by the middle of 2005,

and this level was in fact exceeded in the late summer. In Germany,

this has led to a continuation of the positive stock market trend already

observed in the previous year. The question of the duration of this up-

ward trend nevertheless remains open, since there is still no evidence

of an effective, lasting domestic economic recovery.

Both in Germany and worldwide a degree of reticence on capital

markets can be observed, in particular on the part of private investors.

The reasons for this remain the uncertain international political situa-

tion and fear of terrorism and violence. Attacks continued after the

elections in Iraq early in 2005, and those that took place in London

and in Egypt during the summer created renewed pessimism on the

trading floor. The raw materials market situation also suggests that

excessive stock market optimism would be misplaced. Price increases

for steel and oil in particular have regularly had a negative effect on

stock market prices during the review year.

Despite this situation, Porsche stock has been able to increase its

value significantly. At the beginning of the company’s fiscal year in

August 2004 it was quoted at 537 Euro; at the end of the fiscal year,

in July 2005 it had reached 654 Euro, an increase of 21.8 percent.

In the same period, the Dax index gained 26.5 percent and the auto-

motive industry index 22 percent. The more marked gained made by

these indices compared with Porsche stock are due only to changes

in the Executive Board of a large Dax-listed automobile corporation

which led to a sharp rise in the index at the end of July. For long

periods during the review year, on the other hand, Porsche stock

outperformed the automotive industry index.

Many investors hold the view that Porsche sets itself apart from other

companies in this sector by its policy of focusing clearly on its core

business activities and having pursued a successful and highly profit-

able growth course for a number of years. The stock market has

acknowledged this corporate strategy by way of a steady increase

in the stock price, which reached an all-time high of 685.98 Euro

on July 19, 2005. This peak value evidently tempted a number of in-

vestors to take their profits, with the result that the stock price

subsequently fell back slightly.

Several Stock Price Upsurges

During the review year, Porsche stock passed through three phases

of distinct upward movement; these were associated with the an-

nouncement of good business results and of new models and model

versions. During September 2004, when the world premiere of the

new Boxster took place and provisional results for the 2003/04

fiscal year were announced, the stock price rose to almost 540 Euro.

In the weeks following the stockholders’ annual general meeting,

which was held at the end of January 2005 and at which the figures

for the 2003/04 fiscal year were explained in detail to stockholders,

Porsche stock began its next strong phase of upward movement,

reaching 570 Euro in March and thus almost equaling the previous

year’s peak value. Among other factors, this positive trend reflected

the satisfactory business progress made in the first half of the

review year.

From May until some way into July, the stock price continued to rise

steadily, surmounting the 600-Euro barrier at the beginning of June.

The stock was at times only 15 points short of the 700-Euro mark

during this upward movement, which was fueled by a further interim

report and by the outstanding market successes of the latest 911

and Boxster model generations, but also by speculation concerning

a possible fourth Porsche model line.

The strength of Porsche stock also benefited from the company’s

close contacts with active financial market participants. Corporate

perspectives were explained in detail to institutional investors and

analysts at road shows held at the main financial centers at home and

abroad and in the course of intensive discussions at Porsche’s head-

quarters in Zuffenhausen. These activities resulted repeatedly in a

commitment to Porsche stock. Investors and analysts were above all

impressed by the strategy that enabled the Cayenne to record highly

successful growth in a segment new to Porsche. The new generations

of sports cars were also given a most positive reception. In view

of this situation, the majority of financial market experts continued to

recommend the purchase of Porsche stock, and at the end of the

fiscal year many of them raised their stock price forecasts again.

Porsche Stock 2004 ⁄ 05

In July 2005 the Porsche share price reached its highest level so far,

at 686 Euro