Porsche 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Finances/Porsche Stock26

Porsche AG’s pre-tax profit went up from 843 million Euro to 872 mil-

lion Euro; its after-tax profit improved from 488 million Euro in the

previous year to 528 million Euro.

The increase in overall unit sales also had a positive effect on Group

sales revenue, which went up by 6.9 percent to 6.574 billion Euro.

Despite this marked increase in unit sales, the cost of materials only

rose from 2.875 billion Euro in the previous year to 2.950 billion

Euro, and accounted for 44.4 percent of overall sales revenues as

opposed to 45.4 percent in the previous year. This item reflects the

changed model mix and also the success of our cautious currency

hedging policy.

Although the Porsche Group’s personnel expenses rose from 949.7

million Euro to 964.8 million Euro, the proportion of total sales fell

from 15.0 to 14.5 percent. Other operating expenses were cut from

1.221 billion Euro to 1.211 billion Euro, so that they amounted to

only 18.2 percent of total sales in the reporting year compared with

19.3 percent in the previous year.

Financial income rose to 18.8 million Euro (previous year: 16.0 mil-

lion Euro). Tax provisions of 459 million Euro represented a tax ratio

of 37.1 percent (previous year: 39.3 percent), a drop resulting from

lower rates of tax at certain subsidiaries.

Foreign currency and cash management

The foreign currencies most important to Porsche fluctuated signi-

ficantly again during the past fiscal year. In view of this situation, the

strategy of securing the currencies most important to the company

in the medium term and thus creating a stable planning platform

once again proved to be worthwhile. The currency hedging strategy

is based on analysis of the principal national economies and on tech-

nical currency and analytical models. After this, various instruments

are implemented to protect Porsche against exchange rate risks.

Hedging agreements are concluded only with banks of high standing,

so that the risk of failure is minimized. We also secure loans made to

Group companies by means of interest-rate agreements.

Currency and cash management organization is in accordance with

the standard drawn up by German industry, and is subject to strict

internal control, with directives stating the nature and extent of these

transactions and the procedures to be adopted. The basic principle

of segregation of functions is adhered to, and special data proces-

sing systems are employed for the evaluation and monitoring of all

transactions. Porsche’s investment policy complies with the basic

principle that investment security takes clear precedence over any

attempt to secure an unusually high return on investment. We there-

fore deposit our cash with banks of impeccable creditworthiness in

the form of overnight or fixed-term loans. In addition, Porsche also

invests in money-market funds and makes use of special security

investment funds when liquidity has to be deposited in the medium

or even long term.

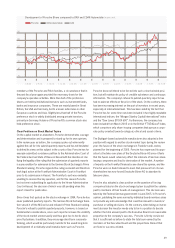

Group Balance Sheet Structure Proportions in percent

Assets 03 ⁄ 04

26.4

6.9

32.6

34.1

25.0

5.9

31.8

37.3

32.4

40.5

27.1

35.2

35.7

29.1

Assets 04 ⁄05 Liabilities 03 ⁄04 Liabilities 04 ⁄ 05

Equity

Long-term Liabilities

Short-term Liabilities

Non-current Assets

Inventories

Trade Receivables,

Other Assets and

Prepaid Expenses

Securities and

Liquid Assets