Porsche 2004 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168

|

|

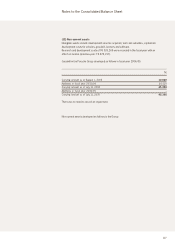

Notes to the Consolidated Financial Statements Notes to the Consolidated Balance Sheet

132

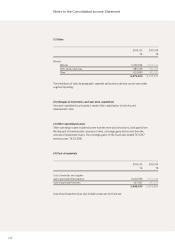

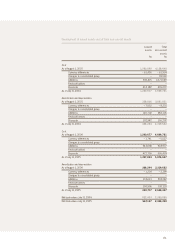

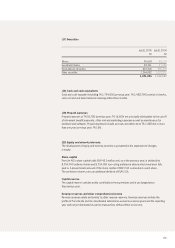

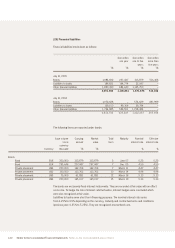

In its financial services division, the Porsche Group acts as lessor, primarily leasing its own

products. The remaining terms of the minimum lease payments from non-cancellable operating

leases of T€ 345,167 (previous year: T€ 402,311) are as follows:

The development of leased assets in the fiscal year is shown in the statement of changes in non-

current assets. The leases also contain renewal and purchase options as well as escalation clauses.

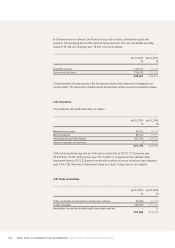

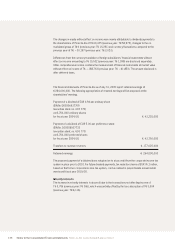

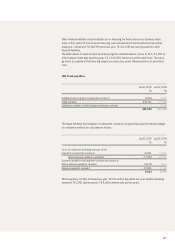

Of the total inventories reported as of the balance sheet date of T€ 571,772 (previous year:

T€ 625,542), T€ 191,744 (previous year: T€ 171,841) is recognized at net realizable value.

Impairment losses of T€ 5,236 were recorded with an effect on income in the fiscal year (previous

year: T€ 4,708). Reversals of impairment losses as a result of disposals are not material.

July31,2005 July31,2004

T€ T€

Due within one year 118,191 172,409

Due in one to five years 226,976 229,902

345,167 402,311

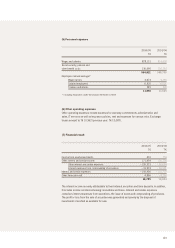

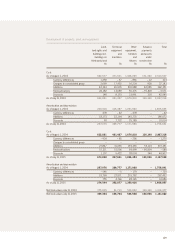

(13) Inventories

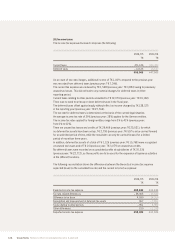

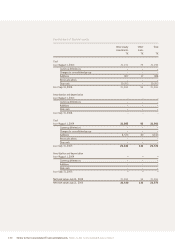

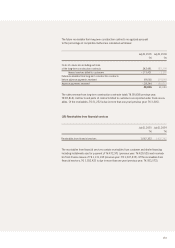

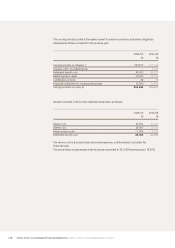

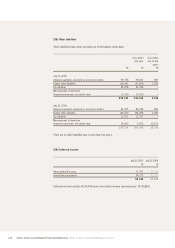

(14) Trade receivables

The inventories disclosed break down as follows:

July31,2005 July31,2004

T€ T€

Materials and supplies 85,252 78,167

Work in progress 49,152 63,075

Finished goods and merchandise 437,359 478,524

Advance payments on inventories 9 5,776

571,772 625,542

July31,2005 July31,2004

T€ T€

Future receivables from long-term construction contracts 40,816 39,080

Trade receivables 266,850 271,601

Receivables from entities in which equity investments are held – 54

307,666 310,735