Porsche 2004 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements

Other

Notes

144

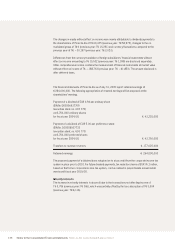

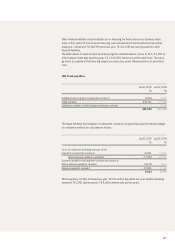

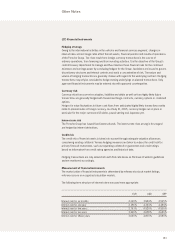

The market value of the financial derivatives is disclosed in the balance sheet under other

receivables and assets or other liabilities. The currency hedges for the Canadian, Australian and

US dollar are due within four years, and those for other currencies within three years. In the fiscal

year 2004/05 there were also stock price hedging options with a market value of T€ 11,093.

As of July 31, 2005, other comprehensive income contains a total of T€ 179,304 (previous

year: T€ 368,067) recorded without effect on income from measurement at market value.

Of the change in measurement at market value recorded in equity of T€ – 188,763 (previous

year: T€ – 41,853), an amount of T€ 21,319 (previous year: T€ 1,345) is due to the increase

in the reserve for the available-for-sale financial assets and T€ – 210,082 (previous year:

T€ – 43,198) to the decrease in the reserve for cash flow hedges. An amount of T€ 250,738

was reclassified in the fiscal year from the reserve for cash flow hedges to the income statement

(previous year: T€ 258,792). The increase came to T€ 40,715 (previous year: T€ 215,649).

The profit on the disposal of available-for-sale securities totaled T€ 7,696 (previous year: T€ 12),

while the loss on the disposal came to T€ 2,808 (previous year: T€ 4,243).

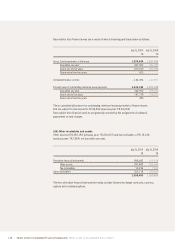

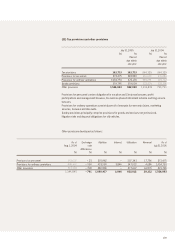

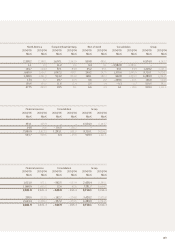

July 31, 2005 July 31, 2004

Nominal Total Nominal Total

volume market value volume market value

T€ T€ T€ T€

Currency hedge 10,729,102 645,645 9,877,413 880,943

Interest hedge 2,001,750 41,943 1,320,595 34,685

12,730,852 687,588 11,198,008 915,628

Currency hedge 341,293 11,298 ––

Interest hedge 96,623 2,092 68,940 14,653

437,916 13,390 68,940 14,653

Assets

Equity and

liabilities