Omron 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

What are the Company’s policies

regarding capital, such as its share-

holder return and financial policies?

Q

Reinforcing Our Defense with Loans and

Improving Cash Flow

Omron’s policy on the distribution of profits is to pro-

vide the maximum amount possible to shareholders

from the Company’s surplus cash account after deter-

mining that sufficient funds are maintained for internal

reserves for essential R&D, capital investment, and

other business growth-related investment, and in con-

sideration of the current level of free cash flow. Our

policy is to maintain a minimum 20% dividend payout

ratio and to target 2% dividend on equity (DOE) ratio.

In fiscal 2008, taking into consideration the result

of a ¥29.2 billion net loss, we distributed ordinary div-

idends of ¥25 per share, representing a ¥17 decrease

from the previous fiscal year and a DOE ratio of 1.7%.

We have not yet set the dividend rate for fiscal 2009 as

we feel it is prudent to wait until we have a better idea

of how business conditions will develop and how the

Company is progressing toward its forecast targets in

this environment.

Our financial policy at present is to preserve our

cash holdings to ensure we are fully prepared for unan-

ticipated contingencies. In fiscal 2008, we secured

approximately ¥20 billion in long-term loans for this

purpose. In fiscal 2009, we plan to improve total cash

flow by approximately ¥25 billion by lowering inven-

tories (¥15 billion) and reducing capital investment

(¥10 billion). In accordance with the anticipated ongo-

ing decline in sales in fiscal 2009, we plan to reduce

How will Omron be changed when it emerges from this difficult period?

Q

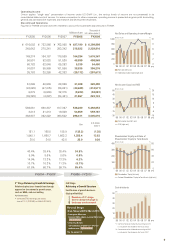

Operating Income of ¥100 Billion when Sales

Recover to ¥750 Billion

When we reached our high point for operating

income—¥65.3 billion in fiscal 2007— the Company

had been in business for 75 years. For fiscal 2009, a

mere two years later, we are challenging ourselves to

attain positive zero operating income. Nevertheless,

as we discussed earlier, we are approaching this as

“positive zero” because it will represent a significant

structural reform achievement.

We plan to steadily reinforce our profit structure

and substantially lower our breakeven sales point as

foundational steps for the Company’s future. Our spe-

cific goal is to reform and improve our profit structure

so that when we raise sales back to the ¥750 billion

level achieved in fiscal 2007, our profit structure will

yield operating income not of ¥65.3 billion but sur-

passing ¥100 billion.

The Omron Group is not content to bow our heads

and wait for the storm to blow over. We are forging

ahead with our heads held high as we put into prac-

tice our motto— “Change! Challenge! Create!”

Strengthen Profit Base in the Medium Term

2007

(Actual)

2008

(Actual)

2009

(Planned)

201

X

(Target)

Mainly through

emergency

measures

(Billions of yen)

(FY)

Net sales Operating income

100.0

65.3

5.3 +0

750.0

763.0

627.2

510.0

Mainly through

structural

reform

Approx. JPY 60 bn

improvement

Maintain BEP of

approx. JPY 500 bn

in sales by

restricting/offsetting

fixed costs

increase and reducing

variable cost ratio

8.8

-2.0

3.3

0.8

10.5

10.3

Depreciation Expense and Capital Investment

04 05 06 07 08 09

Initial Plan

(Billions of yen)

(FY)

Net Capital

Investment

Capital

Investment

Depreciation

Expense

37.4 41.1 44.4 37.1

33.5

36.3

33.9

30.8

28.6

27.0

36.8

25.0

R&D expenses by ¥8.9 billion and reduce the propor-

tion of R&D expenses to sales down to 7.8%.

Investment in R&D is directly related to investment

in business growth and is not usually an area where

we would want to economize. Given the current eco-

nomic environment, however, we are concentrating

R&D spending on fortifying our competitiveness in

mechanical components and in specific fields with

strong growth potential, particularly MEMS and envi-

ronmental businesses.