Omron 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FY2008∼FY2010

2nd Stage Balancing Growth & Earnings

Reinforcing business foundations through

aggressive investment in growth areas,

such as M&A, and cost cutting.

Achievements

• Increased EPS (earnings per share)

from ¥110.7 (FY2003) to ¥185.9 (FY2007).

FY2004∼FY2007

Revision of 3rd stage

due to abrupt change in

business environment

3rd Stage

Achieving a Growth Structure

Fortification of growth business

(high profitability)

Revival Stage

(from February 2009 to March 2011)

• Emergency Measures

(In fiscal 2009, reduce costs by ¥60 billion)

• Structural Reform

(Strengthening of profit base over the

medium term)

Go to page 14

26 months

14 months

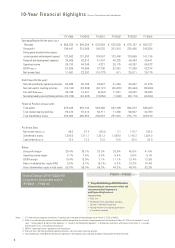

Millions of yen

Thousands of

U.S. dollars (note 1)

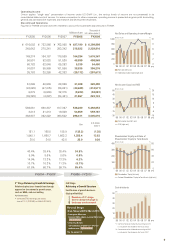

Operating Income

Omron applies “single step” presentation of income under US GAAP (i.e., the various levels of income are not presented) in its

consolidated statements of income. For easier comparison to other companies, operating income is presented as gross profit less selling,

general and administrative expenses and research and development expenses.

Discontinued Operations

Figures for FY2002 onward have been restated to account for businesses discontinued in FY2007.

02010099 03 04 05 06 07 08

Billions of yen %

(FY)

Net Sales and Operating Income Margin

Net sales [left axis]

Operating income margin [right axis]

0

200

400

600

800

1,000

0

2

4

6

8

10

(FY)

02010099 03 04 05 06 07 08

Billions of yen %

Net Income (Loss) and ROE

Net income (loss) [left axis]

ROE [right axis]

-30

-15

0

15

30

45

60

-10

-5

0

5

10

15

20

(FY)

Shareholders’ Equity [left axis]

Ratio of Shareholders’ Equity to Total Assets [right axis]

02010099 03 04 05 06 07 08

Billions of yen %

Shareholders’ Equity and Ratio of

Shareholders’ Equity to Total Assets

0

100

200

300

400

0

20

40

60

80

02010099 03 04 05 06 07

*2

*1

08

yen

Cash dividends

(FY)

0

10

20

30

40

50

FY2005

¥ 616,002

248,642

149,274

50,501

60,782

91,607

35,763

51,699

(43,020)

8,679

(38,320)

589,061

3,813

362,937

151.1

1,548.1

30.0

40.4%

9.9%

14.9%

10.7%

61.6%

FY2006

¥ 723,866

278,241

164,167

52,028

62,046

95,969

38,280

40,539

(47,075)

(6,536)

(4,697)

630,337

21,813

382,822

165.0

1,660.7

34.0

38.4%

8.6%

13.3%

10.3%

60.7%

FY2007

¥ 762,985

293,342

176,569

51,520

65,253

101,596

42,383

68,996

(36,681)

32,315

(34,481)

617,367

19,809

368,502

185.9

1,662.3

42.0

38.4%

8.6%

13.3%

11.3%

59.7%

FY2008

¥ 627,190

218,522

164,284

48,899

5,339

38,835

(29,172)

31,408

(40,628)

(9,220)

21,867

538,280

54,859

298,411

(132.2)

1,355.4

25.0

34.8%

0.9%

6.2%

(8.7%)

55.4%

FY2008

$ 6,399,898

2,229,816

1,676,367

498,969

54,480

396,276

(297,673)

320,490

(414,571)

(94,081)

223,133

5,492,653

559,787

3,045,010

(1.35)

13.83

0.26

U.S. dollars

(note 1)

Yen

9

*1. Commemorative dividend amounting to ¥7.0

is included in the dividends for fiscal 2003.

*2. Commemorative dividend amounting to ¥5.0

is included in the dividends for fiscal 2007.