Omron 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

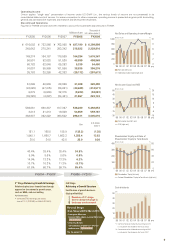

Grand Design 2010 (GD2010)

Long-term corporate vision

(FY2001∼FY2010)

FY2001∼FY2003

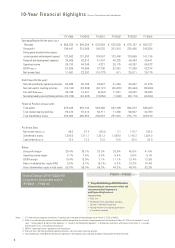

Notes: 1. U.S. dollar amounts represent translations of Japanese yen at the approximate exchange rate on March 31, 2009, of ¥98=$1.

2. Profit or loss (excluding the balance of obligation settled) recognized on the transfer of employee pension fund liabilities in March 31, 2006 is not included in “cost of

sales,” “selling, general & administrative expenses,” or “research and development expenses,” to enable easy comparison with previous fiscal years. It is assumed

that this profit or loss is allocated in one lump sum.

3. EBITDA = Operating income + depreciation and amortization.

4. Free cash flow = Net cash provided by operating activities + net cash used in investing activities.

5. Cash dividends per share represent the amounts applicable to the respective year, including dividends to be paid after the end of the year.

1st Stage Establishing a Profit Structure

Concentrating on cost structure reform and

restructuring the Company as a

profit-generating business.

Achievements

• ROE 10%

• Withdrawal from unprofitable business,

spin off of Healthcare business.

• Raising the level of corporate governance

to the global standard.

Operating Results (for the year): (note 2)

Net sales

Gross profit

Selling, general and administrative expenses

(excluding research and development expenses)

Research and development expenses

Operating income

EBITDA (note 3)

Net income (loss)

Cash Flows (for the year):

Net cash provided by operating activities

Net cash used in investing activities

Free cash flow (note 4)

Net cash provided by (used in) financing activities

Financial Position (at year end):

Total assets

Total interest-bearing liabilities

Total shareholders’ equity

Per Share Data:

Net income (loss) (basic)

Shareholders’ equity

Cash dividends (note 5)

Ratios:

Gross profit margin

Operating income margin

EBITDA margin

Return on shareholders’ equity (ROE)

Ratio of shareholders’ equity to total assets

10-Year Financial Highlights Omron Corporation and Subsidiaries

FY1999

¥ 555,358

196,447

133,662

36,605

26,180

57,625

11,561

59,926

(34,180)

25,746

(23,785)

579,489

69,472

336,062

45.0

1,308.6

13.0

35.4%

4.7%

10.4%

3.5%

58.0%

FY2000

¥ 594,259

218,065

131,203

42,513

44,349

76,566

22,297

50,796

(32,365)

18,431

(24,582)

593,144

67,213

325,958

87.4

1,311.1

13.0

36.7%

7.5%

12.9%

6.7%

55.0%

FY2001

¥ 533,964

180,535

134,907

41,407

4,221

37,790

(15,773)

33,687

(40,121)

(6,434)

(12,056)

549,366

58,711

298,234

(63.5)

1,201.2

13.0

33.8%

0.8%

7.1%

(5.1%)

54.3%

FY2002

¥ 522,535

201,816

133,406

40,235

28,175

57,851

511

41,854

(30,633)

11,221

(1,996)

567,399

71,260

251,610

2.1

1,036.0

10.0

38.6%

5.4%

11.1%

0.2%

44.3%

FY2003

¥ 575,157

235,460

139,569

46,494

49,397

77,059

26,811

80,687

(34,484)

46,203

(28,119)

592,273

56,687

274,710

110.7

1,148.3

20.0

40.9%

8.6%

13.4%

10.2%

46.4%

FY2004

¥ 598,727

245,298

141,185

49,441

54,672

83,314

30,176

61,076

(36,050)

25,026

(40,684)

585,429

24,759

305,810

126.5

1,284.8

24.0

41.0%

9.1%

13.9%

10.4%

52.2%

8