Omron 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

President Sakuta Discusses Omron’s Future

The three main control-based businesses remain susceptible to economic fluc-

tuations. What steps have been taken to address this issue?

Q

Building a Production Structure Resilient to

Fluctuations in Demand

The industrial sector is the main market for IAB, ECB,

and AEC and, for that reason, their results are inevitably

prone to fluctuate with the economy. We can, how-

ever, take steps to make them more adaptable to

changes in the business climate by dispersing opera-

tions geographically and diversifying business content.

Nevertheless, the global recession has made this sus-

ceptibility glaringly apparent. While acknowledging

that an impact is inevitable during periods of growing

economic uncertainty, we must urgently increase their

resilience to fluctuations in demand.

One step, which we will take while concurrently

ramping up production capacity for EMC, will be to

create an optimized, hierarchical manufacturing sys-

tem. We are gathering our specialized technologies in

materials, processing, metal molds, and other areas

into our integrated “mother” plant in Japan. These

technologies form the nucleus from which arises the

unmatched strength of Omron’s products. From this

centralized factory, we will then supply products,

assembly equipment, and inspection equipment to

mass-production plants and subcontractors around

the world. We will also retool our second-tier mass-

production factories around the world for mass

production of general-purpose products and continue

supporting our subcontractors in other regions by com-

missioning small-scale production of general-purpose

products. This three-tier hierarchy of manufacturing

operations will further raise QCD while remaining

resilient to fluctuations in demand.

Optimal Hierarchy (Factory)

Integrated factory

(Domestic “mother” factory)

Established elemental technology

Supplying key parts and equipment for

assembly and inspection

Mass-production factories

(Worldwide)

Large-scale production of general-

purpose products

Supporting subcontractors

Subcontractors

(Worldwide)

Low volume production of general-

purpose products

Efficient And Strengthened Production Capabilities by Three-tiered

Hierarchy System

Consolidating strengths of the three main control-based businesses

FA Business EMC ME

Auto-

motive

relay,

switches

ECU

etc.

IAB

Mechanical Components Business

New growth fields (MEMS, etc)

Spin off

ECB AEC

)

FA Business

ME

Spin off

ECU

etc.

IAB

Others

AEC

Strengths:

Distribution channeles

for general-purpose products

Strengths:

Global production capabilities

and technologies

FA: Factory Automation EMC: Electronic and Mechanical Components (Electronic mechanical components, such as relays, switches, connectors, etc.) ME: Micro Electronic components

(Electronic components, MEMS, and other electronic components such as liquid-crystal backlights, etc.) ECU: Electronic Control Units (Automotive electronic control units)

Production

of automotive

relays and

switches

Production

of industrial

relays and

switches

EMC

a roughly 50% increase in staff, and creating stronger

alliances with domestic distributors. We also plan to

integrate the sales and marketing functions of ECB’s

distribution channels into IAB.

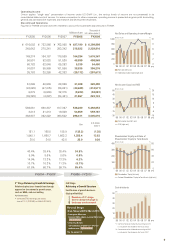

Omron’s share of the domestic market for control

equipment remains solid at roughly 40%, according

to Nippon Electric Control Equipment Industries

Association standards, but it has slipped by five per-

centage points over the past 10 years. Our

performance objective is to regain market share of

45% over the short term.

We have decided to have ECB focus its expertise

on mechanical components and rename the segment

the Electronic and Mechanical Components (EMC)

Business Company, with the new name taking effect

in September 2009. EMC will take over the develop-

ment and manufacturing of mechanical components

currently conducted in each of the IAB, ECB, and AEC

segments to provide integrated development and

manufacture of industrial, consumer electronics,

telecommunication, and automotive relays, switches,

and connectors.

With ECB focusing on mechanical components,

micro electronic (ME) components operations will be

shifted from ECB to the Others segment. Micro elec-

tronic components encompass liquid-crystal backlights

and micro electro mechanical systems (MEMS), to

which Omron has dedicated significant effort to date.

ME is rapidly developing into a new growth field and

will be under my direct supervision as we aggressively

develop and expand our ME operations.