Omron 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

To Our Stakeholders

Message from the President

The Worst Net Loss in the Company’s History

The business environment in fiscal 2008 took a dev-

astating downturn in the third quarter that led

manufacturers to further curb production activity while

tightening and even freezing capital investment. These

trends deeply impacted business in our core automo-

tive, semiconductor, and liquid-crystal electronic

components industries, resulting in consolidated net

sales in fiscal 2008 falling 17.8% year on year to ¥627.2

billion. The main elements in this decline were the

sharp rise in the value of the yen combined with plum-

meting demand in the Industrial Automation Business

(IAB), Electronic Components Business (ECB), and

Automotive Electronic Components Business (AEC),

which generate over 70% of the Company’s total sales.

The decline in sales contributed to an accompanying

drop in operating income, which plunged 91.8% year

on year to ¥5.3 billion. The Company additionally booked

impairment losses for goodwill, property, plant and

equipment, and investment securities. The overall result

was a net loss of ¥29.2 billion, marking the worst loss in

Omron’s history.

Shifting to a “Revival Stage” in which Nothing

is Sacred

Fiscal 2008 was slated as the first year of the final three-

year stage of the Company’s long-term corporate

vision, Grand Design 2010 (GD2010). However, in light

of the dramatic changes in the operating environment

we have revised our initial plan, in which we had aimed

to accelerate growth. The revised plan comprises two

strategic phases both commencing in February 2009.

The first is “Emergency Measures,” covering the 14-

month period to March 2010, and the second is

“Revival Stage (Structural Reform)”spanning the 26-

month period to March 2011.

This revision to our medium-term management

plan was ultimately necessitated by the subprime loan

crisis and the so-called Lehman Shock. Although we

repeatedly acknowledged the need to become “lean-

er,” the dramatic change in the external business

conditions has made it clear that we had gained excess

“fat” while achieving six consecutive years of

increased revenues and profits. I would like to express

my deepest apologies for not recognizing the gravity

of the situation and for our severe performance results

for fiscal 2008.

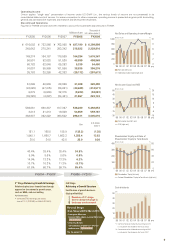

IAB

ECB

AEC

SSB

HCB

Others

HQ Cost/Elimination

Total

51.9

12.6

1.4

7.0

9.4

0.1

-17.1

65.3

FY2007

(Billions of yen)

20.5

-2.0

-6.4

5.4

4.8

0

-17.0

5.3

FY2008

Business

FY2007

Actual

(Billions of yen)

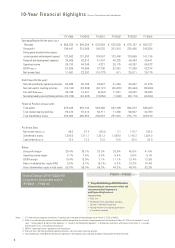

Consolidated Operating Income Analysis (Year-on-Year)

FY2008

Actual

65.3

5.3

-59.2

-17.1

+1.1

+8.8

+6.6

+0.4

-0.6

Operating income down ¥60.0 bn

(Exchange loss: ¥8.3 bn)

Gross profit down ¥74.8 bn

Sales down,

product mix

Exchange

loss

M&A gain

Material

costs down

SG&A, R&D:

Exchange gain

SG&A, R&D

down

SG&A, R&D:

M&A

Consolidated Operating Income by Segment