Omron 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

We are confronting the challenges of the current

conditions with the confidence that we will achieve

profit levels exemplifying complete recovery.

At this point in time, the economic recession

appears to have eased to a certain degree, but we

have not crawled out from the bottom yet. As demand

was brisk in the first half of fiscal 2008, we anticipate

demand to remain substantially below the previous-

year level in fiscal 2009.

Our foremost priority is to look toward the future

and not only survive the current situation but to

reemerge in a strong competitive position. We will

take this opportunity to make our operations “lean and

keen” and take a radical outside-the-box approach to

reform our operations in the core IAB, ECB, and AEC

segments, along with emergency measures to con-

centrate our resources on select domains.

Overcoming Adversity to Achieve Complete

Recovery

We expect the severe operating environment for the

Omron Group to persist in the coming year and fore-

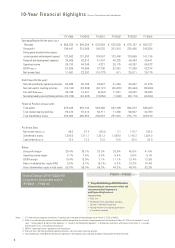

cast fiscal 2009 net sales falling a further 18.7% year

on year to ¥510.0 billion. In addition, under the current

situation, we are seeking to avoid producing a loss for

the year and to achieve operating income of “positive

zero” as a productive step for the future.

We are resolved to confront the challenges of the

current conditions with the confidence that we will

achieve profit levels exemplifying a complete recov-

ery. At this point in time, it is still impossible to set a

target date for achieving recovery. In terms of results,

however, we have set the bar for sales at the fiscal

2007 level of ¥750 billion and for operating income

above ¥100 billion (compared with ¥65.3 billion in fis-

cal 2007). To achieve this, we plan to pare down our

operation to only the most essential elements and sub-

stantially lower the break-even point for sales.

Dividends Depend on Bottom Line and Cash

Reserves

We intend to continue our basic policy for sharehold-

er return of maintaining a minimum 20% dividend

payout ratio, and to continue aiming for a 2% dividend

on equity (DOE) ratio. In fiscal 2008, taking into con-

sideration that we had a net loss of ¥29.2 billion, we

paid an annual dividend of ¥25 per share, which rep-

resented a ¥17 decrease from the previous fiscal year

and a 1.7% DOE ratio.

Based on our target of achieving “positive zero”

operating income in fiscal 2009, we do not expect to

be able to meet our 2% DOE ratio standard. We will

review our bottom line and cash reserve status when

we have a better view of how the business environ-

ment will take shape for the year.

We ask for your patience and understanding until

we can provide a reliable outlook for shareholder return

for the coming year, and we appreciate your ongoing

support as we pull together all of our resources to

achieve full recovery of the Omron Group.

August 2009

Hisao Sakuta, President and CEO

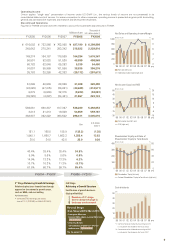

Apr. 2001 Mar. 2011Apr. 2010Apr. 2009Apr. 2008Apr. 2004

“Grand Design 2010” (GD2010) Omron’s long-term management vision

New Long-term

Management

Vision

(Post-GD2010)

1st Stage 2nd Stage 3rd Stage

Revival Stage

(Structural Reform Period)

Emergency

Measures

Abandon the 3rd stage and

designate 26-month period until

Mar. 2011 as “Revival Stage;”

focus on structural reform

2009/2