Omron 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

RETROSPECTIVE ON FISCAL 2004

1. Operating Environment

Entering a short-term adjustment phase

The long-term recovery of the Japanese economy took a

temporary step back in fiscal 2004, ended March 31, 2005,

as the recovery trend entered a period of short-term adjust-

ment. For the Omron Group, our business environment

remained robust in the first half of the fiscal year before

experiencing a reversal from early autumn, when in addition

to the high price of crude oil and other uncertain factors, the

IT and digital consumer electronics markets that had sup-

ported Japan’s export and capital expenditure recovery

experienced an adjustment. Coupled with this is an increas-

ing sense of caution regarding China, which while being a

major growth engine in the world economy is also moving

toward policies that will bring its eco-

nomic overheating under control.

Medium to long-term recovery trend

remains sound

Expectations concerning the medium to

long-term forecast for the Japanese

economy remain strong, due in part to

the belief that Japan has turned the cor-

ner on dealing with its non-performing

loans problem and other structural

reforms. Consumption and employment

levels are also showing a modest yet

steady recovery, while growth in the

Nikkei Stock Average remains brisk.

2. Operating Results of the Omron Group

Three consecutive years of increased sales and profits

In spite of the business environment, the Omron Group

still realized increased sales and profits in fiscal 2004,

again achieving its highest-ever profits and extending the

record began in fiscal 2003. Net sales for the fiscal year

increased 4.1% year-on-year to ¥608.6 billion, operating

income was up 9.2% to ¥56.1 billion, and net income rose

12.6% to ¥30.2 billion. In addition, operating income and

net income each outpaced our initial targets by 3.9% and

4.1%, respectively.

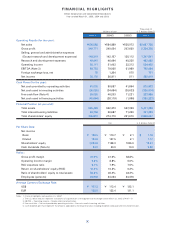

Steep rise in material prices and heavier advance

investments offset by higher net sales

A comparison of operating income with the previous year’s

results demonstrate that as raw material

prices skyrocketed, rising material costs

resulted in a negative impact totaling

about ¥1 billion. Nearly the same

amount, however, was absorbed thanks

to our ongoing cost-saving activities.

Moreover, exchange rate fluctuations

accounted for a negative effect of about

¥800 million, while selling, general and

administrative (SG&A) expenses includ-

ing research and development

expenses to further cement our techno-

logical edge accounted for a negative

effect of about ¥5 billion. Nevertheless,

these negative factors were more than offset by our higher

net sales (about ¥10.5 billion).

Sales growth in nearly all business segments

Asia maintains high growth

As Omron transferred its sales function in the ATM and

other information equipment business market to Hitachi-

Omron Terminal Solutions Corp. (HOTS), a joint venture in

which we hold a 45% stake, in October 2004, our overall

sales grew by only 4.1%. Excluding this special factor,

however, sales growth stood at 8%. Each of our individual

segments apart from the Social Systems Business (SSB),

which was affected by the aforementioned special factor,

recorded higher sales in fiscal 2004. In the Industrial

Automation Business (IAB), sales of equipment and control

components for factory automation as well as industrial

equipment remained strong domestically and in Europe.

The Omron Group has now entered a phase of growth with an offensive/defensive bal-

ance, and our strategy to achieve our midterm goals is steadily gaining results. We will

cement our solid footing with vigilance, while making every effort to enhance our top line

growth potential by boldly accelerating our advance investments.

HISAO SAKUTA

President and CEO

Message from the President

Breakdown of Changes in Operating Income (Billions of yen)

FY2003

Sales increase

Operating income Operating income

Exchange

losses Rise of

the cost of

materials

Cost

reductions,

etc.

Increase in

SG&A expenses -2.1

R&D expenses -2.9

FY2004

51.4

10.5

56.1

-0.8

-1.0 -1.0

Change in gross profit

Change in

SG&A expenses,

R&D expenses