Omron 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

¥49.4 billion to ¥50.0 billion. As for details regarding tech-

nology that distinguishes the Group from its competitors for

the purpose of expanding new business domains, please

see the feature, “Technology-Driven Sustainable Growth

Begins Now” (pages 11-14).

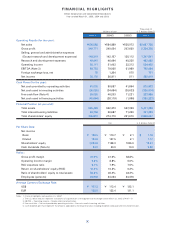

Doubling total business value

The final goal of GD2010 2nd Stage is to double the total

business value of our various businesses through the

abovementioned strategies. We define business value as

the present value, calculated by discounting the future free

cash flow anticipated from the Group’s various business

domains. According to our internal estimates, total busi-

ness value in fiscal 2003 reached ¥600 billon. Going

forward, we will make every effort to increase this value to

¥1.2 trillion by fiscal 2007. For fiscal 2004, the business

value of existing businesses increased by ¥120 billion,

while that of new businesses and business domains went

up by ¥130 billion. In fiscal 2005, we aim to increase the

total business value by ¥110 billion.

APPROACHES TO STRENGTHEN THE MANAGEMENT

SYSTEM AND THE RETURN TO SHAREHOLDERS

Strengthening governance and

promoting active information disclosure

Even as the Omron Group firms up our defense, we are

pursuing a strategy of gradually shifting our footing toward

top line growth. I am well aware that the quicker our

growth, the more our risk will increase. In order to pursue

sustainable growth while controlling that risk, we must

continually improve management transparency and sound-

ness, and earn the unwavering support of our stakeholders

by strengthening governance and promoting more active

information disclosure. It is also important that we fulfill

our corporate social responsibility (CSR) and fully imple-

ment compliance strategies. Gaining the support of not

only our shareholders, but our broad range of stakeholders

including society at large, is a fundamental principle that

has been deeply embedded in the fabric of Omron since

its founding.

Return to shareholders based on a medium to long-term

expansion of corporate value and appropriate dividends

I am well aware that tackling the issue of return to share-

holders with a positive commitment is another managerial

mission, and one that ultimately enhances corporate value.

We intend to continue toward our goal of a dividend payout

rate of 20% of consolidated current net income. Our policy

is to maintain a minimum annual dividend of ¥10 per share

even in the event of deteriorated business results. The divi-

dend for fiscal 2004 was increased by ¥4 to ¥24 for the

year, in line with this goal. However, as the Omron Group is

shifting its management to an offensive footing, we will

give priority to the distribution of profits to retained earn-

ings for the purpose of investment in line with growth,

aiming to achieve a medium to long-term increase in corpo-

rate value. As for cash flows beyond that, we will not only

pay dividends but also actively repurchase our own shares

and return as much value as possible to our shareholders.

It is both our mission and our pleasure at the Omron Group

to use our technological edge to provide better products

and services to meet various social needs in order to earn

the further confidence of all of our stakeholders. Your con-

tinued support will be greatly appreciated.

July 2005

Hisao Sakuta, President and CEO

Definition of Business Value

New Technological Fields

Simulate 10-year FCF based on

five-year plan.

Stabilize FCF with lasting value

after 11 years.

Existing + Greater China Market

Simulate 3-year FCF

Stabilize FCF with lasting value

after 4 years.

Omron defines business value as the total of present values

of future FCF (Free Cash Flow) generated by each business unit

Lasting value

Business value 1

FY11 & after FY4 & after

Lasting value

Business value

DCF:

Present value

of FCF

DCF:

Present value

of FCF

Double the Total Business Value

2004 (FY)2005

(Plan)

2003 2007

(Tar get)

1,200

800

200

400

1,000

600

0

(Billions of yen) New Tech Fields Existing Businesses

600

600

850

720

250

950

800

1,200

130

160

960