Omron 2005 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2005 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

For the Electronic Components Business (ECB), exports of

mobile components increased sharply, mainly to China. In

the Healthcare Business (HCB), blood pressure monitors,

body composition monitors, and other healthcare devices

for home use recorded steady sales. With respect to the

Automotive Electronic Components Business (AEC), sales

of relays, sensors, and other electronic parts for automo-

biles, which are becoming increasingly automated, also

showed tremendous growth in Europe and Asia. Geograph-

ically, sales grew both in Japan and overseas. In particular,

overseas sales grew by 8% (27% in China on a dollar

basis), continuing the high growth trend from fiscal 2003.

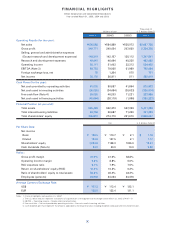

Strengthening our financial foundation,

improving management efficiency and other

structural improvements to produce ongoing results

We are continuing to strengthen our balance sheet, reduc-

ing our total interest-bearing liabilities by ¥31.9 billion from

the end of fiscal 2003 and shrinking inventory by ¥1.7 bil-

lion. At the same time, a ¥31.1 billion increase in total

shareholders’ equity resulted in a ratio of shareholders’

equity to total assets of 52.2%, a significant year-on-year

increase of 5.8 percentage points. Our cost structure

improvements have also shown further progress, with the

ratio of SG&A expenses to net sales falling 0.8 percentage

points year-on-year to 23.5% (excluding extraordinary fac-

tor of response to hazardous chemical substance

regulations), and the fixed manufacturing cost ratio falling

0.8 percentage points to 16.2%.

Quick start toward growth based on

an offensive/defensive balance

As a result of the foregoing, we achieved business expan-

sion while recording a return on shareholders’ equity (ROE)

of 10.4%, thereby maintaining the absolute target of 10%

set out in the Omron Group’s long-term management plan

Grand Design 2010 (GD2010). In so doing, we have moved

from our phase through fiscal 2003 that emphasized

“defense” in the form of improved stability (stronger profit

structure) to a stage under which continued attention is

given to stability improvement (firmed up defense), while

simultaneously realizing increased growth potential

(“offense”). This is the basic policy of GD2010 2nd stage

(FY2004-2007). I strongly believe that the aforementioned

results are indicative of a smooth start in fiscal 2004, the

first year of the 2nd stage, and are perfectly in line with

that basic policy.

FUTURE OUTLOOK AND BASIC STRATEGY

Two Basic Strategies: Operating Structure Reform and

Business Domain Reform

The Omron Group aims to increase sales and profits in fis-

cal 2005. In particular, as of July 2005, we aim to record

¥625 billion in net sales (a 2.7% increase over fiscal 2004),

¥65 billion in operating income (15.8% increase), ¥36 bil-

lion in net income (19.3% increase), and an ROE of 10.8%

(0.4 percentage point increase). While we will naturally

strive to achieve these fiscal 2005 goals, I believe that my

mission as President and CEO is to go beyond these and

to include a medium to long-term perspective in our oper-

ations. As such, this means improving the three elements

of corporate value—profitability, growth potential, and sta-

bility—in a balanced manner, and expanding corporate

value by building a strong profit structure capable of with-

standing volatility in the external environment. There are

two main policies toward this purpose. The first is operat-

ing structure reform that strengthens profitability and cost

structure. The second is business domain reform that

identifies growth markets and technologies to pursue, and

continually recombines business domains toward top line

growth. We will take a medium to long-term stance in

business domain reform, through which the Omron Group

will establish its future footing. We will also determine and

closely watch growing sectors, regions, and technologies,

Japan Overseas Production (Excluding China Area) China Area Production

Global Production Reform

2004 (FY)2003 2007

(Target)

400

300

100

200

0

71%

20%

9%

67%

21%

12%

51%

19%

30%

(Billions of yen)

Production in

Greater China

to increase by

4.5 times

SG&A Expenses Reform

2004 (FY)2005

(Plan)

2003 2007

(Target)

800

600

200

400

0

(Billions of yen) Sales SG&A Expenses

24.3%

584.9 608.6

625.0

71% 22.0%

28% sales

growth planned

Increase of SG&A

expenses controlled

23.3%

23.5%

750.0

* Excluding extraordinary factor of response to hazardous chemical substance regulations

in FY2004 and FY2005

※※