Olympus 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 OLYMPUS Annual Report 2013 15OLYMPUS Annual Report 2013

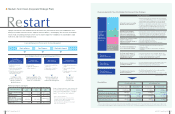

Restart

Rebuilding of

Business Portfolio /

Optimizing Allocation of

Management Resources

Results and Challenges

Restoration of

Financial Health

Review and

Reduction of Costs

Back to Basics Profitable GrowthOne Olympus

Restructuring of

Corporate Governance

Olympus announced a new medium-term vision for the ve years from the scal year ended March 2013.

Acting in accordance with the vision’s slogan of “Back to Basics,” the Company aims to return to the basic

values it had at founding and make a fresh start in order to regain the credibility of its stakeholders, build

itself anew, and create new corporate value.

Basic Strategies Based on Corporate Management Policies

Corporate Management Policies under the New Management

Performance Indices and Targets

1. Clarifi cation of our core

businesses

2. Identifi cation and liquidation

of non-core businesses

3. Establishment of mechanisms

to drive optimal allocation of

management resources

Contribute to total

wellness of people as a

company centered on

Medical Business

Improve pro tability of the

entire Group through drastic

review of cost structures

Improve equity ratio as

soon as possible and

realize stable management

Recover trust

and improve

corporate value

1. Cost reduction

2. Signifi cant curtailment of

indirect expenses

1. Steady fl ow of profi ts from

businesses

2. Maximization of cash fl ow

3. Streamlining of assets

1. Restructuring of governance

system

2. Reinforcement of internal

controls

3. Strengthening of the compli-

ance system

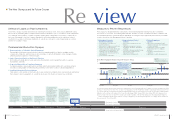

Results of implementing these basic strategies will

be monitored based on four performance indices:

“return on invested capital (ROIC)*,” “operating

margin,” “free cash fl ow,” and “equity ratio.”

* Return on Invested Capital (ROIC)

ROIC is an index that measures income generated on

a company’s invested capital (IC). At Olympus, ROIC is

calculated using the following assumptions:

Return (Operating income after taxes) / IC (Shareholders’

equity + Interest-bearing debt)

* Compared with March 31, 2012

Performance Indices

FY ended March

2012

(Results)

FY ended March

2013

(Results)

FY ending March

2017

(Target)

Return on invested capital

(ROIC) 2.7% 2.7% 10% or more

Operating margin 4.2% 4.7% 10% or more

Free cash ow

(Cash ow from operating

activities + cash ow from

investing activities)

¥(4.8) billion ¥58.7 billion ¥70.0 billion or

more

Equity ratio 4.6% 15.5% 30% or more

FY ending March 2015 FY ending March 2017

Previous target Revised target Previous target Revised target

Net sales ¥1,010 billion ¥760 billion ¥1,160 billion ¥920 billion

Operating income (Operating margin) ¥90 billion

9%

¥93 billion

12%

¥130 billion

11%

¥143 billion

16%

Ordinary income (Ordinary income ratio) ¥70 billion

7%

¥70 billion

9%

¥115 billion

10%

¥125 billion

14%

Net income (Net income ratio) ¥40 billion

4%

¥45 billion

6%

¥85 billion

7%

¥85 billion

9%

Notes:

1. Figures for previous targets are those from when the medium-term vision was initially announced on June 8, 2012. Revised target fi gures refl ect the revision released on May 15, 2013.

2. Previous foreign exchange assumptions called for exchanges rates of ¥80 to US$1 and ¥100 to 1 EUR. Revised assumptions projected exchanges rates of ¥90 to US$1 and ¥120 to 1 EUR.

Medium-Term Vision (Corporate Strategic Plan)

Progress during the First Year of the Medium-Term Vision and Future Challenges

Rebuilding of

Business

Portfolio /

Optimizing

Allocation of

Management

Resources

1

1 2 3 4

Medical Achieved forecast-exceeding

progress and performance

Gastrointestinal endoscope fi eld: Introduced new products,

such as EVIS EXERA III (Europe and U.S.) and EVIS LUCERA

ELITE (Japan), which contributed to increased earnings

Surgical device fi eld: Introduced the new VISERA ELITE

(Europe, U.S. and Japan) surgical video endoscopy system

Commenced business alliance with Sony Corporation and

jointly established Sony Olympus Medical Solutions Inc.

Management resource allocation: Increased production

capacity of major production sites

P. 3 0

Review and

Reduction of Costs

2Achieved certain degree of

results, however, continued

rationalization of indirect

departments needed

Made progress in stabilizing

operating foundations

Strengthened structures for

greater effectiveness

Reorganized production sites worldwide: 30 22 sites

Staff size optimization: reduced staff by approx. 6,000*

people, achieved target ahead of schedule

(includes full-time and part-time employees)

Restructuring of

Corporate Governance

4 Instituted new management system clearly separating

supervision and business execution

Security on Alert designation removed on June 11, 2013

Restoration of

Financial Health

3 Increased capital: Commenced capital alliance with Sony

Equity ratio: Improved from approx. 5% to over 15%*

Interest-bearing debt: Decreased ¥82 billion*

Imaging

Responded to rapidly changing

market conditions and

implemented drastic reform of

earnings structure

Revised product lineup: Shifted to high-value-added prod-

ucts, such as mirrorless cameras

Reorganized manufacturing systems

Implemented SG&A expense reduction measures

P. 4 2

Life Science &

Industrial

Implemented pro tability

improvement measures in

response to deterioration of

macroeconomic environment

Introduced new products in mainstay model lines on schedule

Rationalized production sites and improved operational

effi ciency by closing a site in the Philippines and consoli-

dating sites in Nagano in preparation for future growth

P. 3 8

Restructuring of

non-core

businesses

Accelerated reorganization of

non-core business domains

Transferred Information & Communication Business

(September 2012)

Liquidated / sold approx. 30 subsidiaries and affi liated

companies

Financial Plans