Olympus 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

3,000

2,000

1,000

4,000

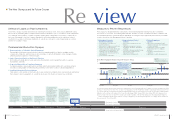

August 2011 January 2012 June 2012 January 2013 July 2013

2 OLYMPUS Annual Report 2013 3OLYMPUS Annual Report 2013

Re

The New Olympus and Its Future Course

1. Overconcentration of Authority in Senior Management

The president at that time possessed authority for decisions regarding selection of director candidates and the

compensation of directors, and there was an overconcentration of authority attributable to senior managers, thereby

preventing suffi cient supervision of these managers.

2. Lack of Supervisory Function of the Board of Directors

Both inside and outside directors were selected by the president, which impeded their ability to supervise

management objectively.

3. Corporate Culture with Low Compliance Awareness

Compliance awareness was exceptionally low, and there were Companywide problems with corporate governance

structures, including neglect for internal reporting and internal control divisions without suffi cient independence.

4. Insuffi cient Information Disclosure Systems

There were no solid systems for information disclosure, and decisions related to disclosure were made arbitrarily by

the Company’s senior management. As a result, the disclosure of information for investors was insuffi cient.

Problems Identi ed within Olympus

In the 1990s, Olympus incurred substantial losses stemming from fi nancial assets. The Company deferred recording

these losses by transferring them to multiple funds that existed outside the scope of consolidation. It then overpaid fees

associated with the acquisitions of certain companies, diverting these overpayments to the funds to compensate for

the losses. Subsequent to that, the Company attempted to resolve the unrealized losses through the recording of

amortization of goodwill on its fi nancial statements. As a result, we continued to conduct inappropriate accounting

practices for a number of years.

Deferral of Losses on Past Investments

• Losses on investment in

fi nancial assets expand

following the collapse of

Japan’s bubble economy.

• Prior to the introduction

of market value account-

ing in April 2000, unreal-

ized losses on the

relevant fi nancial assets

had been separated from

the consolidated ac-

counts by transferring

them to multiple funds

at book values.

• The off-balance-sheet

losses are eliminated by

taking advantage of the

purchase of three domes-

tic subsidiaries.

• Deferred recording of past

losses is discovered.

• The Third Party Committee

is established to investi-

gate the issue.

• The investigation report is

received from the Third

Party Committee.

• The committee explains the

need to improve gover-

nance and take steps to

prevent recurrences.

• The Company establishes

the Management Reform

Committee, the Director

Liability Investigation

Committee, and the

Non-Director Liability

Investigation Committee.

• The reports of the Director

Liability Investigation

Committee and the

Non-Director Liability

Investigation Committee

are received, and a suit for

damages is fi led against

past managers.

• The Company’s stock is

designated by the TSE

as a Security on Alert

(January 21).

April 2012March 2012

Clari cation of

improvement

measures

January 2012December 2011November 20112008 – 20101990s June 2012

The Company has established internal scrutiny teams, which have developed the following measures to prevent the

reoccurrence of such issues. In formulating these measures, the teams took into consideration the areas of weakness and

recommended measures to prevent recurrences identifi ed in an investigation report prepared by the Third Party Committee

as well as the advice of the Management Reform Committee.

1. Strengthen Corporate

Governance Structure

• Clear separation of executive and

supervisory functions

• Reinforcement of supervisory authority and

functions over executive functions

• Fairness in selection of outside directors and

audit & supervisory board members, and

expansion of the roles and functions of

outside directors and audit & supervisory

board members

• Active disclosure of information

2. Improve Internal Control

Systems

• Improvement of internal checks and

balances

• Appropriate management of business

investments, subsidiaries, and affi liated

companies

• Prevention of fraudulent activities through

improvements to human resource

management systems

• Enhancement of internal audits

3. Review Compliance

Systems

• Improvement of management team’s

compliance awareness, and establishment

of clear accountability

• Establishment of systems to support

further reinforcement of compliance

promotion

• Fostering of consistent awareness of

compliance

• Improvement of whistle-blowing systems

Measures to Prevent Recurrences

view

May 2012

Internal system development period

Development of regulations

Development of system

In conjunction with the discovery of the deferred recording of past losses in November 2011, the Company’s stock price plummeted to ¥424

per share, its lowest level ever. Since then, we have received guidance from the Third Party Committee and formulated measures to prevent

reoccurrence while also revising internal systems and implementing an array of other initiatives. As a result, we were able to submit a written

affirmation on the internal control system to the Tokyo Stock Exchange (TSE) in January 2013. Later, in May 2013, the Company’s stock

price recovered to the level seen before the scandal came to light, regardless of the fact that Olympus was still undergoing investigations.

Further, immediately after the issues surfaced, coverage of Olympus by sell-side analysts dropped to one company, but the number has

since recovered to 11 as of July 2013.

Stock Price Changes from Discovery of the Issues to Today

(¥)

Low (Nov. 11)

¥424

April 2012

• A special general meeting of

shareholders is convened.

• A new management team is

appointed and all members of the

old management team resign.

January 2012

• Security under Supervision

designation is cancelled, and the

Company’s stock is designated

Security on Alert (January 21).

January 2013

• Submission of written affi rmation on

the internal control system to TSE.

July 2013

• Plan to offer new shares and

existing shares of treasury stock

to overseas investors is approved.

June 2012

• The medium-term vision (corpo-

rate strategic plan) geared toward

creating a new Olympus is announced

by the new management team.

High (May 23)

¥3,570