Olympus 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 OLYMPUS Annual Report 2013 23OLYMPUS Annual Report 2013

Incident regarding Deferred Posting of Past Losses

How has Olympus changed? After the scandals, what measures should Olympus institute, and how should it

target future growth? President Hiroyuki Sasa conversed with analysts that have observed Olympus for a number

of years with regard to the expectations of the Company and the challenges it faces, receiving their earnest

opinions and advice. (Conversation held on June 10, 2013, in a meeting room of the Company’s head of ce)

Masahiro Nakanomyo

Managing Director

Barclays Securities Japan

Limited

Profile

Mr. Nakanomyo joined The

Mitsubishi Banking Corp. in

1984, where he undertook

a variety of industry and

corporate research projects

over a 25-year period. In

2009, he joined Barclays

Securities Japan and leads

the precision instrument

sector coverage team in the

equity research section.

J.P. Morgan Securities Plc.

Hisashi Moriyama

Goldman Sachs Japan Co., Ltd.

Toshiya Hari

President and Representative Director

Hiroyuki Sasa

Barclays Securities Japan Limited

Masahiro Nakanomyo

Toshiya Hari

Managing Director

Global Investment Research,

Goldman Sachs Japan Co., Ltd.

Profile

Mr. Hari joined Goldman Sachs

Japan in 2001 after graduating

from the London School of

Economics and Political

Science. After several years

in a supporting role as junior

analyst, he became the lead

analyst for the Semiconductor

Capital Equipment sector in

2007 and for the Precisions

sector in 2009.

Hisashi Moriyama

Senior Analyst

Equity Research Division,

J.P. Morgan Securities Plc.

Profile

Mr. Moriyama began his career at

New Japan Securities Inc. After

eight years in sales, he was

transferred to the company’s

investment study department.

Later, he joined the Tokyo Branch

of Credit Lyonnais Securities Asia,

where he was responsible for the

precision equipment and electronic

components sectors. In 2002, he

entered J.P. Morgan Securities

and was placed in charge of the

precision equipment sector.

Sasa I would like to begin by

apologizing for the great inconvenience

and concern we caused through the

scandals that were discovered in the year

before last. I was quite surprised when

this issue surfaced, and I feared Olympus

itself may cease to exist. At that time, I was a division

manager in charge of marketing for the entire Medical

Business. To reassure my subordinates after the issue

surfaced, I reminded them of the Company’s solid operating

foundations exemplifi ed by its endoscopes. There was no

way this foundation would just disappear. Even if Olympus

ceases to exist, endoscopes will never vanish. Drawing

their attention to this fact, I encouraged them to focus on

maintaining business operations and to fi ght for the

Company’s survival in their own way.

In all, the development and manufacturing staff were

relatively calm. They were confi dent that their endoscopes

would not disappear, and they continued to supply us

with high-quality products and services steeped in this

confi dence. Meanwhile, the sales staff was subjected to a

fl urry of inquiries and questions from physicians, receiving

both reprimand and encouragement. Even under these

The Creation of a New Olympus and Future Growth—Conversation with Analysts

harsh circumstances, they remained devoted to recovering

the trust of the Company, and thus helped us pull through

this diffi cult period. In January 2012, it was decided that

Olympus would remain listed on the Tokyo Stock

Exchange. At that moment, I felt assured that we could

return Olympus to glory if we remained committed.

Nakanomyo With regard to the deferred

posting of past losses, I feel this incident

was partially due to the failure of us, as

analysts, in performing our duties. I think

there was an extent to which this issue

could have been predicted before the

discovery of the misrepresentation from the Company’s

disclosed fi nancial information. Regardless, the incident

caught us all by surprise. As participants in the capital

market, it is our duty to monitor such activities, and I feel

responsibility in my failure to do so. At the same time,

there is a nagging sense of disbelief directed toward the

Company that still remains today. I believe it will be up to

Olympus to dispel this disbelief through its future actions.

At the very least, this disbelief partially vanished after you

were appointed as president, Mr. Sasa.

Moriyama When the issue surfaced, I

was fi lled with disappointment and anger,

as though I had been betrayed by a friend

of many years or someone else I deeply

trusted. To be perfectly honest, I feel

that the Company’s actions were greatly

disappointing, whether viewed from the perspective of the

Japanese stock market or the rest of the world. I had no

choice but to stop covering Olympus as a result. However,

over the year that followed the change in management,

a number of statements were released by Olympus. In

particular, I felt that the announcement of measures for

restructuring the Imaging Business in May 2013 best

communicated the Company’s sincerity. The announcement

was simple yet moving. Quite frankly, I did not expect

Olympus to put out any statements that exceeded the

expectations of the market. However, when I saw the plan

to halve compact camera sales targets, making for a target

that is unprecedentedly low by the Company’s standards,

my opinion immediately took a position swing. My view of

Olympus has nearly completed a 180-degree turn from a

year ago.

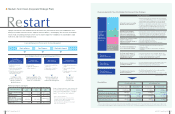

Sasa The impacts of this issue are not limited to the

Company. Rather, these impacts also weigh heavily on the

Japanese stock market. As such, how Olympus should go

about regaining the trust of the market was a matter we

worried much over. It was determined that accomplishing

the goals of the medium-term vision was of utmost priority.

We realized that if we cannot accomplish the fi gures set out

in the plan, then it will be impossible to recover trust. Now,

one year later, I still cannot say that Olympus has changed

suffi ciently. Looking at our fi nancial position, the equity ratio

has only recovered to around 16%, and this is far from

enough. We are also faced with the major management

task of returning the Imaging Business to profi tability. For

these reasons, I think we can say that we are still not

effectively producing results. Nevertheless, what we must

do remains clear. Our mission now is to steadily address

the tasks we face one at a time.

Hari We upgraded our rating

on Olympus two days before Michael

Woodford was removed from his position

as president and CEO, and I remember

becoming quite emotional after the

incident surfaced. At the same time,

I blamed myself for my inability to catch on to the

misrepresentation through disclosure materials, which,

while perhaps diffi cult, could not have been impossible to

see. After you were appointed as president, Mr. Sasa, the

speed at which the Company’s governance systems and

business portfolio improved has been startling, with much

being accomplished in a short period. Next, I hope you will

shift your focus to achieving further growth in the Medical

Business. While discussion tends to be directed toward

what will be done in the Imaging Business and the Others

Business, I feel that the Company’s core business remains

as the Medical Business.

Refl ect