Olympus 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 OLYMPUS Annual Report 2013

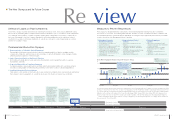

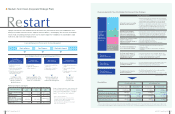

February–June 2013January 2013July–December 2012

Implementation of improvement measures

Internal system operational period Inspection period

June 2012May 2012

Internal system development period

Development of regulations

Development of system

January 2013

Submission of

written afrmation

on the internal

control system

to TSE.

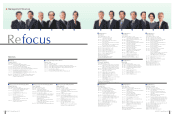

1. Overconcentration of Authority in Senior Management Establishment of Independent Committees

We have established the Nominating Committee and the Compensation Committee, which are comprised primarily

of highly independent outside officers, effectively separating authority related to corporate officer nomination and

compensation from management.

Under the guidance of these committees, the Company has transformed significantly. At the suggestion of the

Compensation Committee, we introduced a stock option system to reflect our shareholders’ perspective into

compensation. Also, based on the nomination of the Nominating Committee, we appointed a female outside director.

2. Lack of Supervisory Function of the Board of Directors Clear Segregation of Business Execution

and Supervisory Functions

The Board of Directors now consists of a majority of outside directors, and these and other corporate officers are

appointed based on the nominations of the Nominating Committee, ensuring complete independence from management.

This system also allows for clear segregation of the business execution function, handled by inside directors and

executive officers, and the decision-making function and supervisory function of the Board of Directors. Further, the outside

directors offer advice backed by their specialized knowledge, which serves to improve the quality of management.

3. Corporate Culture with Low Compliance Awareness Appointment of a CCO and Establishment

of the Compliance Committee

We have appointed a chief compliance officer (CCO) to promote compliance in a managerial capacity and established

the Compliance Committee, which is chaired by an outside director. This new system has been used to foster

compliance awareness and advance Groupwide governance reforms. In addition, an internal compliance-related

reporting system has been established to cultivate a more open corporate culture.

4. Insufficient Information Disclosure Systems Development of More Stringent Internal

Information Disclosure Rules

The Company’s internal information disclosure rules have been made more stringent, and we have developed unique

disclosure standards that are even stricter than those of the TSE. Also, we actively disclose information that is deemed of

importance to investors, regardless of whether or not this is called for under disclosure standards.

Improvement Measures and Olympus of Today

1 2

3

4

By adopting an executive officer system, Olympus has established a governance structure that separates the functions of

executive officers, who are responsible for the performance of business operations, and directors, who are responsible for

management decision making and the supervision of the performance of operations. In addition, in consideration of the

scandal, we are further clarifying this separation, strengthening supervisory functions, and taking steps to reinforce systems

for promoting compliance.

For more information regarding the new corporate governance structure, please refer to page 48

June 2013

Removal of the Security on Alert

Designation

On January 21, 2012, the TSE designated

the Company’s stock as Security on Alert.

Aiming to have this designation lifted, we

formed an internal project team and pulled

together to rebuild the corporate

governance structure and strengthen

compliance functions. As a result of these

efforts, the designation was removed from

the Company’s stock on June 11, 2013.

June 2012

• The medium-term vision (corporate strategic

plan) geared toward creating a new Olympus is

announced by the new management team.

“Back to Basics” is established as a new slogan,

and Olympus sets about making a fresh start.

September 2012

• A business and capital alliance with

Sony Corporation is announced.

Improved nancial soundness is

pursued, and synergies are created

in business domains through such

means as establishing a joint

venture medical company.

May 2013

• Restructuring measures for

the Imaging Business are

announced.

Basic policy of risk

minimization is dened, and

the development of earnings

structures that do not depend

on scale of sales is targeted.

June 2013

• A stock option

system is introduced

for corporate ofcer

compensation.

Corporate officer

compensation

schemes are changed

to strengthen link to

performance and

stock price.

August 2012

• The transference of the

Information & Communication

Business is announced.

The reorganization of non-core

business domains is accelerated

to help rebuild the Company’s

business portfolio.

Corporate Governance Structure (Summary) Compliance Promotion System (Summary)

Board of

Directors

President

Each

Organization

General Meeting of Shareholders General Meeting of Shareholders

Accounting Auditor

President and

Representative

Director

Board of Directors

Executive Management Committee

Nominating

Committee

Compensation

Committee

Chairman

Chairman

Chairman of

the Board of

Directors

Audit & Supervisory Board

Executive

Management

Committee

CSR

Committee

CCO

Europe Americas Asia Japan

Global Compliance Meeting

Compliance Committee

Compliance Promotion

Committee

Actions undertaken by the compliance

organization within each region

1

3 4

2

New Management Structure

Corporate Governance Structure of the New Olympus

OLYMPUS Annual Report 2013 5OLYMPUS Annual Report 2013 4

April 2012

•Aspecialgeneralmeetingof

shareholders is convened.

•Anewmanagementteam

consisting of a majority of

outside directors is appointed

and all members of the old

management team resign.

Number of timely disclosure documents released (April 2012–July 2013) 78

bornRe

The New Olympus and Its Future Course

1. Overconcentration of Authority in Senior Management

The president at that time possessed authority for decisions regarding selection of director candidates and the

compensation of directors, and there was an overconcentration of authority attributable to senior managers, thereby

preventing sufficient supervision of these managers.

2. Lack of Supervisory Function of the Board of Directors

Both inside and outside directors were selected by the president, which impeded their ability to supervise

management objectively.

3. Corporate Culture with Low Compliance Awareness

Compliance awareness was exceptionally low, and there were Companywide problems with corporate governance

structures, including neglect for internal reporting and internal control divisions without sufficient independence.

4. Insufficient Information Disclosure Systems

There were no solid systems for information disclosure, and decisions related to disclosure were made arbitrarily by

the Company’s senior management. As a result, the disclosure of information for investors was insufficient.

Problems Identied within Olympus

In the 1990s, Olympus incurred substantial losses stemming from financial assets. The Company deferred recording

these losses by transferring them to multiple funds that existed outside the scope of consolidation. It then overpaid fees

associated with the acquisitions of certain companies, diverting these overpayments to the funds to compensate for

the losses. Subsequent to that, the Company attempted to resolve the unrealized losses through the recording of

amortization of goodwill on its financial statements. As a result, we continued to conduct inappropriate accounting

practices for a number of years.

Deferral of Losses on Past Investments

•Lossesoninvestmentin

financial assets expand

following the collapse of

Japan’s bubble economy.

•Priortotheintroduction

of market value account-

ing in April 2000, unreal-

ized losses on the

relevant financial assets

had been separated from

the consolidated ac-

counts by transferring

them to multiple funds

at book values.

•Theoff-balance-sheet

losses are eliminated by

taking advantage of the

purchase of three domes-

tic subsidiaries.

•Deferredrecordingofpast

losses is discovered.

•TheThirdPartyCommittee

is established to investi-

gate the issue.

•Theinvestigationreportis

received from the Third

PartyCommittee.

•Thecommitteeexplainsthe

need to improve gover-

nance and take steps to

prevent recurrences.

•TheCompanyestablishes

the Management Reform

Committee, the Director

LiabilityInvestigation

Committee, and the

Non-DirectorLiability

Investigation Committee.

•ThereportsoftheDirector

LiabilityInvestigation

Committee and the

Non-DirectorLiability

Investigation Committee

are received, and a suit for

damages is filed against

past managers.

•TheCompany’sstockis

designated by the TSE

as a Security on Alert

(January 21).

April 2012March 2012

Clarication of

improvement

measures

January 2012December 2011November 20112008 – 20101990s